Apple’s Financial Ambitions Take a Hit

In a surprising move, Apple has announced that it will be discontinuing its in-house buy now, pay later scheme in the US, which was launched just last year. The technology giant has decided to offer customers payment plans through third-party credit and debit card lenders instead.

Apple’s financial ambitions take a hit

Apple’s financial ambitions take a hit

The decision marks a significant retreat for Apple from its plans to offer traditional financial services. Apple Pay Later users in the US could break up the cost of purchases worth up to $1,000 into four instalments over six weeks without having to pay interest or fees. This scheme represented a move into providing financial services, with Apple effectively offering customers loans, instead of resorting to banks and other traditional lenders.

“The company used a new subsidiary, Apple Financing, to issue the loans.”

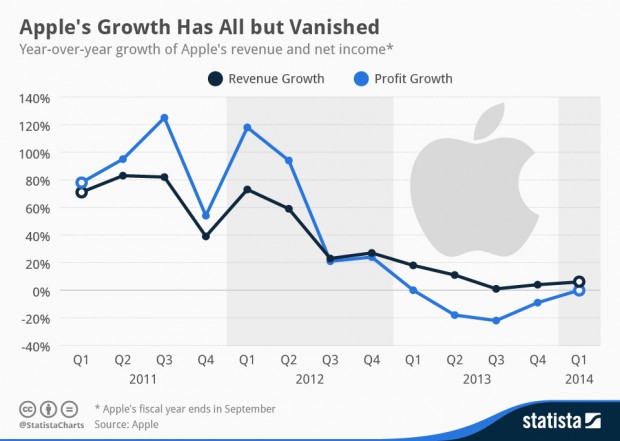

The scheme was launched at a time when US interest rates were close to zero, making borrowing more attractive. However, as central banks put up rates to tackle rising prices, such plans became less appealing.

During its annual developer event last week, Apple announced that it would be partnering with banks, including Citi in the US, HSBC in the UK, and ANZ in Australia, to offer instalment payment options. The new payment options will be made available on its upcoming iOS 18 operating system, which is expected to be released later this year.

Apple’s new payment options

Apple’s new payment options

This move marks a significant shift in Apple’s financial strategy, and it will be interesting to see how this decision affects the company’s financial ambitions in the long run.

Apple’s financial future

Apple’s financial future