Tech Stocks Take a Hit, But Asian Markets Remain Unfazed

The recent slump in tech stocks has sent shockwaves through the global market, but Asian investors seem to be taking it in stride. Despite a mixed day on Wall Street, Asian stocks advanced on Tuesday, with Japan leading the charge.

Asian stocks defy US tech concerns

Asian stocks defy US tech concerns

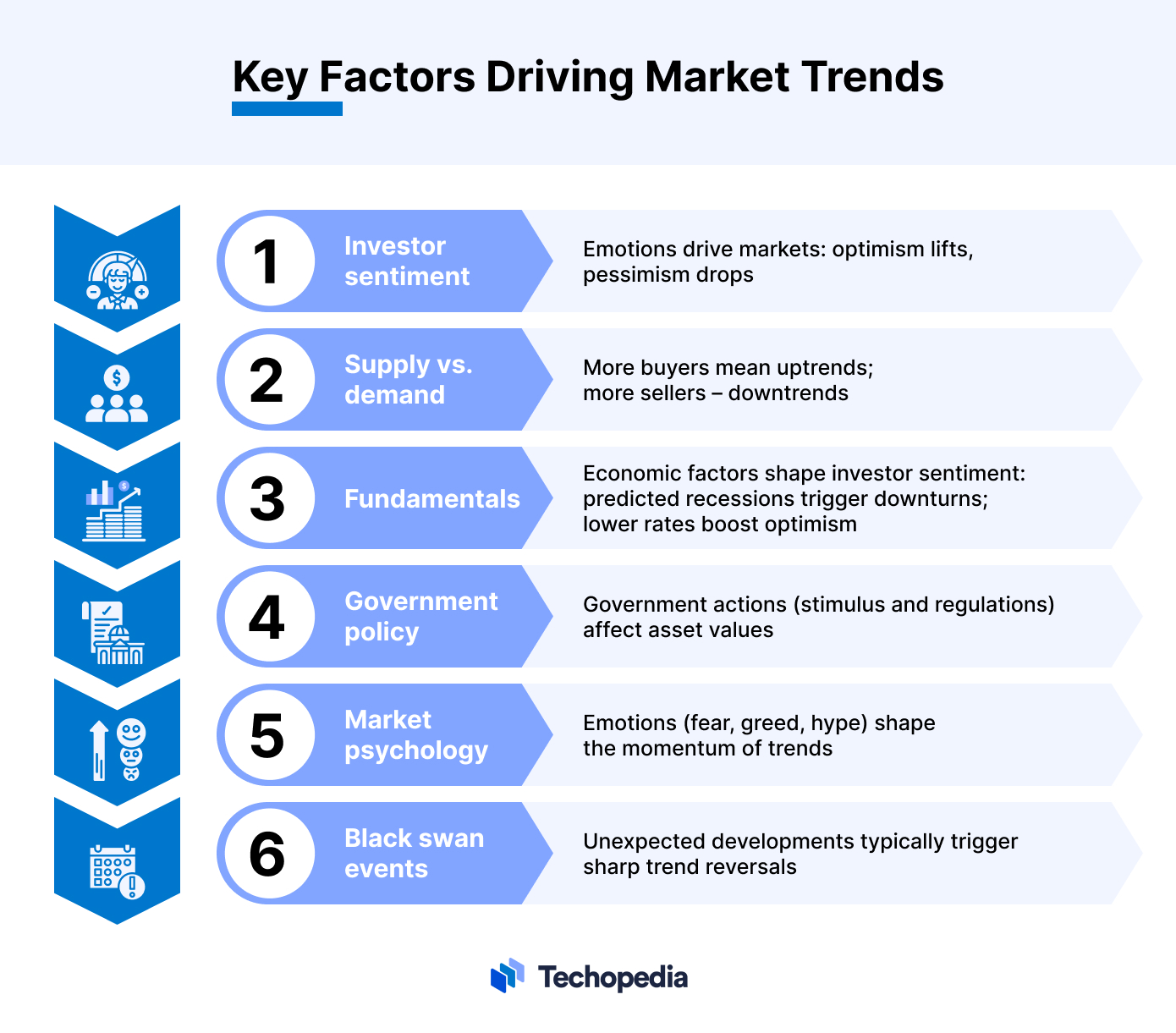

The tech sector’s rally may be running out of steam, but investors in Asia are rotating out of tech and into other parts of the market. Value stocks in Japan, such as financials, are seeing a surge in interest as expectations grow that the nation’s central bank will tighten its policy.

Nvidia’s stock rout continues

Nvidia, the chipmaker at the heart of the artificial-intelligence revolution, extended its three-day rout, crossing the technical threshold of a correction. The stock’s 13% decline has traders scouring charts for support.

Yen strengthens, but still hovers near 34-year low

Yen strengthens, but still hovers near 34-year low

Among currencies, the yen strengthened, but still hovered near its weakest level in about 34 years. The top currency official warned that authorities stood ready to intervene if necessary, while some traders see the potential for the yen to slump as far as 170 per dollar.

Investors rotate out of tech and into other sectors

Investors rotate out of tech and into other sectors

As the market continues to shift, investors are looking for safe havens. The question on everyone’s mind is: what’s next for tech stocks? Will they continue to slide, or is this just a minor correction?

Asian markets shrug off US tech concerns

Asian markets shrug off US tech concerns

One thing is certain: Asian markets are not letting US tech concerns dictate their trajectory. With investors rotating out of tech and into other sectors, it’s clear that the region is looking to diversify its portfolio.

Market volatility continues to rise

Market volatility continues to rise

As the market continues to fluctuate, one thing is clear: investors need to be prepared for anything. Whether you’re a seasoned pro or just starting out, it’s essential to stay informed and adapt to changing market conditions.