Insurtech Firm AutoRek Partners with J.P. Morgan to Enhance Premium Processing

In a move to revolutionize the insurance industry, AutoRek, a leading insurtech firm, has joined forces with J.P. Morgan Payments to improve premium processing and cash allocation for insurance companies. This strategic partnership aims to enhance financial data flows from banking sources, facilitating cash allocation, matching, and credit control.

Image: Insurance Premium

Image: Insurance Premium

The collaboration will provide a seamless experience for clients, offering an end-to-end solution across the entire insurance value chain. Darren Snoxell, head of insurance, EMEA at J.P. Morgan Payments, emphasized the importance of working with a specialist company like AutoRek to deliver tangible benefits to brokers, carriers, reinsurers, multinational insurance programs, captives, and the London market.

“Working with a specialist company like AutoRek will complement our existing solutions to help deliver an end-to-end solution across the entire insurance value chain.” - Darren Snoxell

Piers Williams, global insurance lead at AutoRek, highlighted the powerful combination of proven solutions that this partnership presents. By integrating their systems, insurance firms can streamline their premium receivables process, increasing efficiency, accelerating cash flow, reducing write-offs, and enhancing controls.

“We are proud of this partnership, which presents a powerful combination of proven solutions and will deliver optimal results for clients in the insurance market.” - Piers Williams

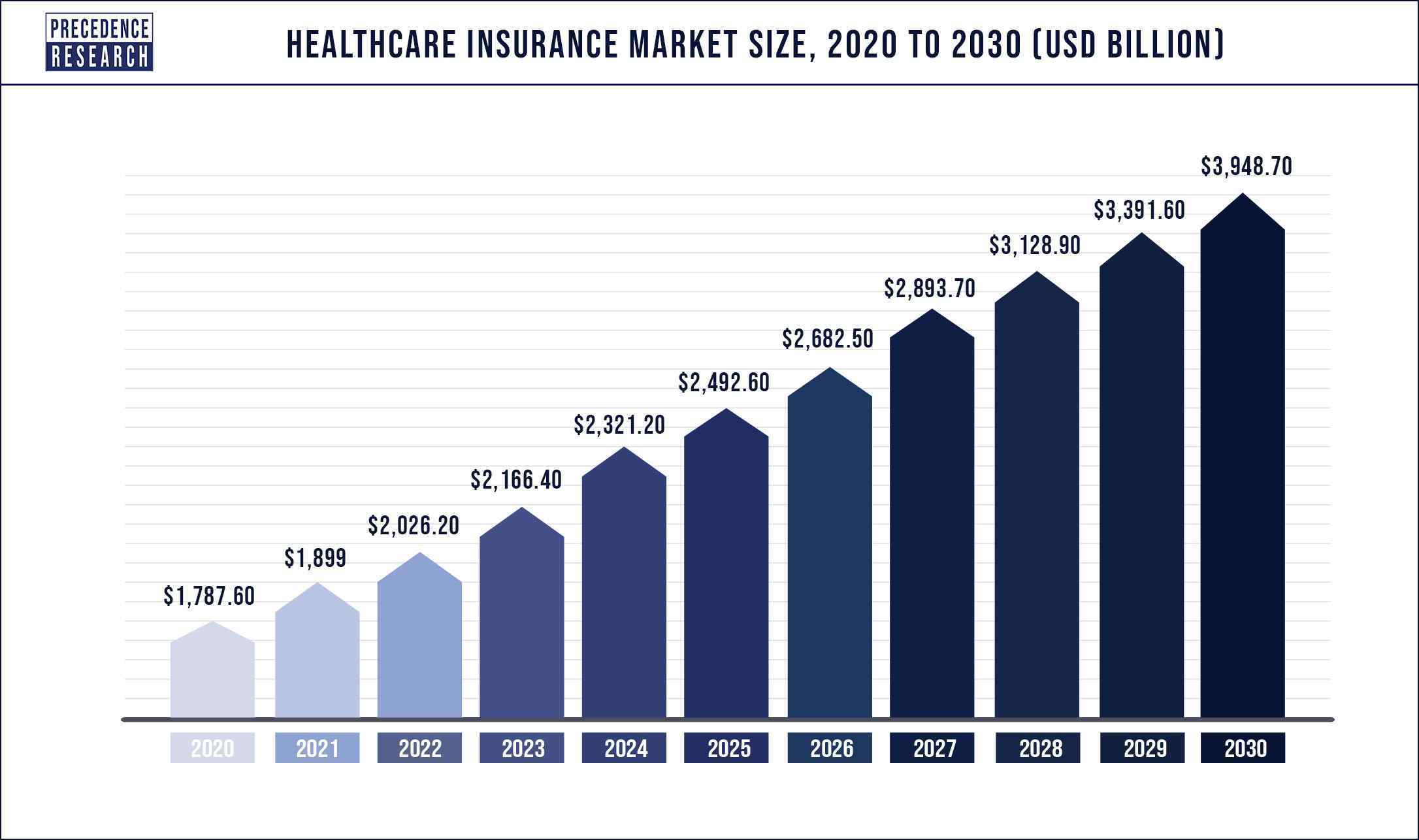

Image: Insurance Market

Image: Insurance Market

This partnership is expected to unlock numerous opportunities for insurance firms to optimize their premium processing and cash allocation. With AutoRek’s expertise in insurance technology and J.P. Morgan Payments’ existing services, clients can look forward to a more efficient and streamlined experience.

Image: J.P. Morgan Payments

Image: J.P. Morgan Payments

By leveraging the strengths of both companies, this partnership is poised to revolutionize the insurance industry, providing a competitive edge to insurance firms and enhancing their overall performance.