Tech Stocks with a Proven Track Record of Dividend Payments

Investors seeking a blend of growth and reliable income often turn to tech stocks with a long history of dividend payments. In this article, we’ll spotlight three companies that have recently announced dividend hikes: QUALCOMM, Analog Devices, and Microchip Technology.

QUALCOMM: A Leader in Wireless Technologies

QUALCOMM Incorporated develops and commercializes foundational wireless technologies worldwide. The company operates through three segments: QCT (Qualcomm CDMA Technologies), QTL (Qualcomm Technology Licensing), and QSI (Qualcomm Strategic Initiatives). QUALCOMM has maintained dividend payments for 22 consecutive years and raised them for 21 years. In April, the company increased its quarterly dividend by 6.2% to $0.85 per share, or $3.40 annually, yielding 1.72%.

Wireless technology is a key area of growth for QUALCOMM.

Wireless technology is a key area of growth for QUALCOMM.

The stock is up more than 37% year-to-date, and the company has beaten consensus EPS and revenue estimates for the last three quarters. Over the past twelve months, QUALCOMM generated $36.4 billion in revenue and $8.38 billion in net income.

Analog Devices: A Global Semiconductor Leader

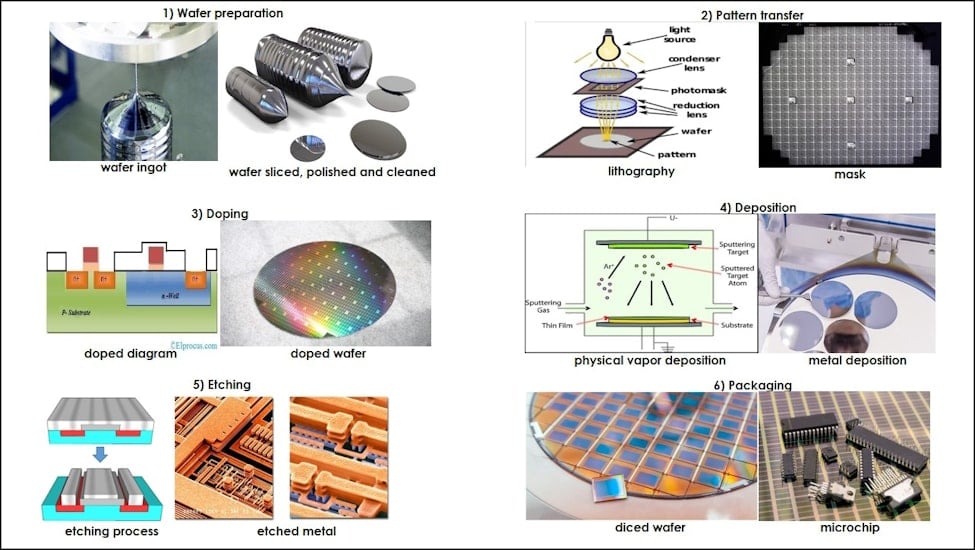

Analog Devices, Inc. designs, manufactures, and markets integrated circuits (ICs), software, and subsystems. The company provides data converter products, power management, and reference products for various applications in automotive, communications, industrial, and consumer markets. Analog Devices has raised its dividend for 21 consecutive years. In February, the company increased its quarterly dividend by 7% to $0.92 per share, or $3.68 annually, yielding 1.62%.

Analog Devices is a leading manufacturer of semiconductors.

Analog Devices is a leading manufacturer of semiconductors.

The stock is up more than 15% year-to-date, and the company has beaten consensus EPS and revenue estimates for the last two quarters. Over the past twelve months, Analog Devices generated $10.46 billion in revenue and $2.14 billion in net income.

Microchip Technology: A Leader in Embedded Control Solutions

Microchip Technology Incorporated develops, manufactures, and sells smart, connected, and secure embedded control solutions globally. The company offers a range of microcontrollers and microprocessors for applications in automotive, industrial, computing, communications, and other sectors. Microchip has maintained dividend payments for 23 consecutive years and raised them for 12 years. In May, the company increased its quarterly dividend by 18% to $0.452 per share, or $1.808 annually, yielding 2.01%.

Microchip Technology is a leading provider of embedded control solutions.

Microchip Technology is a leading provider of embedded control solutions.

Over the past twelve months, Microchip generated $7.6 billion in revenue and $1.9 billion in net income.

“Investors seeking a blend of growth and reliable income often turn to tech stocks with a long history of dividend payments.”

These three companies have demonstrated a commitment to sharing their profits with shareholders, making them attractive options for income-focused investors. With their strong track records of dividend payments and recent hikes, QUALCOMM, Analog Devices, and Microchip Technology are worth considering for those seeking a balance of growth and income.