Falling Tech Stocks Drag Wall Street Lower

The tech-heavy Nasdaq composite index plummeted 1.6% on Friday, leading the broader market downward. Despite the majority of stocks within the S&P 500 rising, the index still fell 0.7%. The Dow Jones Industrial Average, however, managed to eke out a 0.2% gain.

Tech stocks weigh on the market

Tech stocks weigh on the market

Dell’s Disappointing Earnings

Dell’s stock price plummeted 22% despite matching analysts’ forecasts for profit in the latest quarter. The company’s stock had already soared 122% in 2024, leading to high expectations. Analysts pointed to concerns about Dell’s profit margins as a major factor in the stock’s decline.

Dell’s stock takes a hit

Dell’s stock takes a hit

Nvidia’s Momentum Slows

Nvidia’s stock fell 2.4% on Friday, marking a second consecutive losing day. The chip company’s momentum had been soaring, with a 20% gain since its blowout profit report last week. Microsoft and Amazon also saw significant declines, with their stocks falling 2.2% and 2.9%, respectively.

Nvidia’s momentum slows

Nvidia’s momentum slows

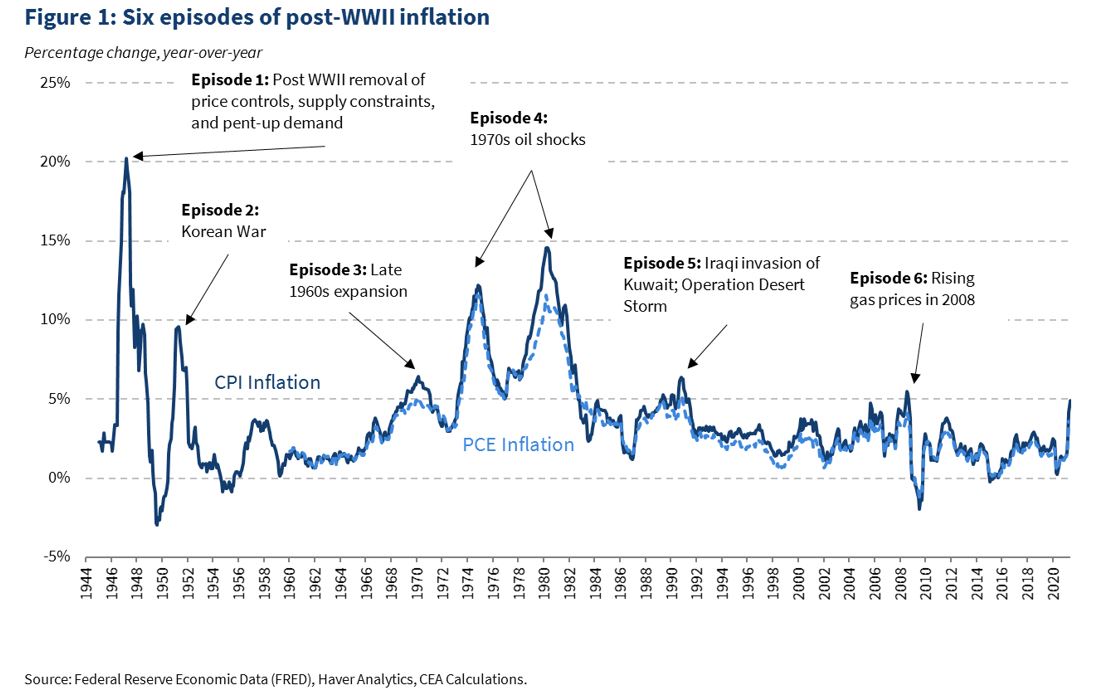

Inflation Concerns Linger

The latest reading on inflation came in roughly as expected, leaving the question of when the Federal Reserve will cut interest rates. The Fed has been keeping the federal funds rate at the highest level in over 20 years, hoping to slow the economy and stifle high inflation.

Inflation concerns persist

Inflation concerns persist

Easing Treasury Yields Bring Relief

Treasury yields fell following the release of the inflation report, providing some relief to the stock market. The yield on the 10-year Treasury fell to 4.51% from 4.55% late Thursday.

Easing Treasury yields bring relief

Easing Treasury yields bring relief

Fed’s Dilemma

The Federal Reserve is caught between slowing growth and high inflation. If it holds rates too high for too long, it could choke off the economy’s growth and lead to a recession.

The Fed’s dilemma

The Fed’s dilemma

Gap’s Surprise

Gap Inc. surprised analysts with stronger-than-expected profit and revenue in the latest quarter. The retailer’s stock jumped 27%, with growth across its brands.

Gap’s surprise

Gap’s surprise

MongoDB’s Disappointment

MongoDB’s stock fell 25% despite topping forecasts for profit and revenue. The company’s forecasts for the current quarter and full year fell short of analysts’ expectations.

MongoDB’s disappointment

MongoDB’s disappointment

Trump Media & Technology Group’s Slump

Trump Media & Technology Group’s stock fell 7.6% in its first trading day following Donald Trump’s conviction on 34 felony charges.

Trump Media & Technology Group’s slump