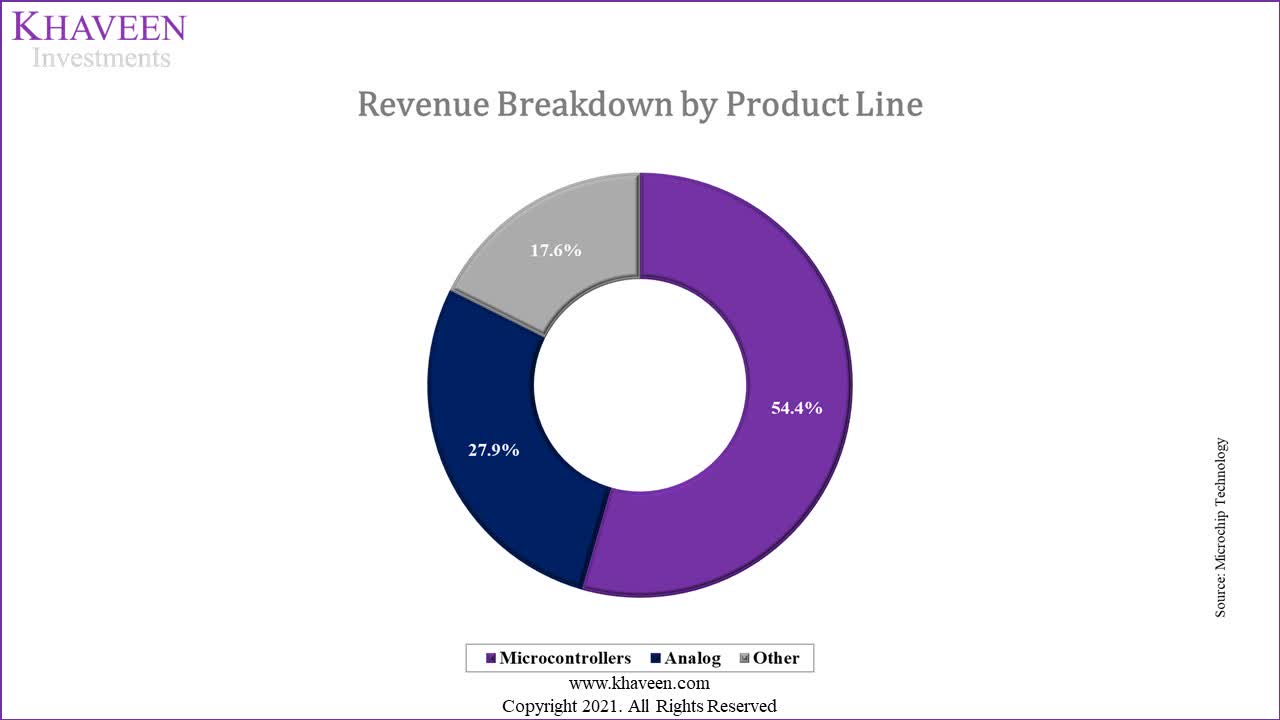

Microchip Technology Insider Selling: A Cause for Concern?

As an investor, it’s essential to keep an eye on insider transactions, as they can provide valuable insights into a company’s prospects. Recently, Microchip Technology’s Executive Chair, Stephen Sanghi, sold a substantial US$3.4m worth of stock at a price of US$93.10 per share. While this sale only accounted for 0.4% of their holding, it’s still worth exploring the implications.

Microchip Technology logo

Microchip Technology logo

The Last 12 Months of Insider Transactions at Microchip Technology

Notably, that recent sale by Stephen Sanghi is the biggest insider sale of Microchip Technology shares that we’ve seen in the last year. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. We note that this sale took place at around the current price, so it isn’t a major concern, though it’s hardly a good sign.

“Insiders sold Microchip Technology shares recently, but they didn’t buy any. Looking to the last twelve months, our data doesn’t show any insider buying.” - Source

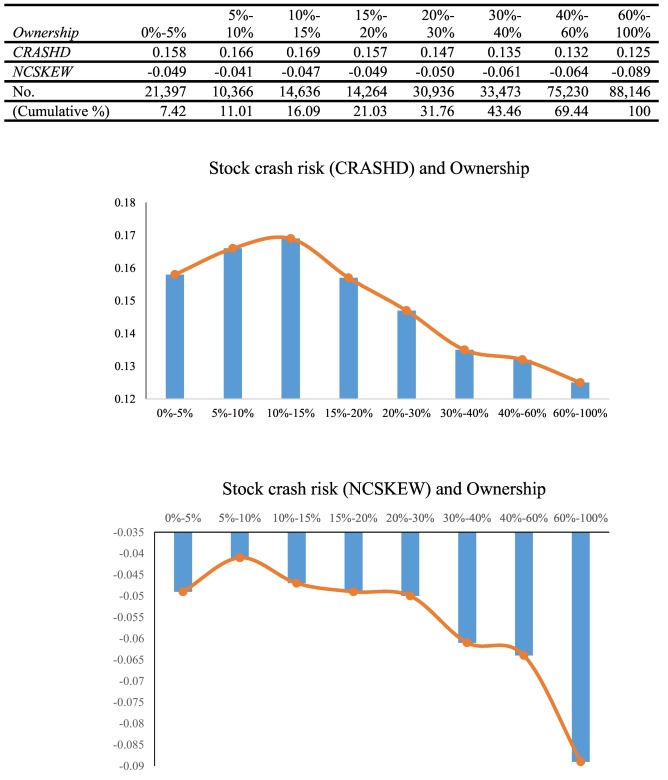

Does Microchip Technology Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Microchip Technology insiders own about US$1.0b worth of shares (which is 2.1% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

Insider ownership

Insider ownership

So What Do The Microchip Technology Insider Transactions Indicate?

Insiders sold Microchip Technology shares recently, but they didn’t buy any. Looking to the last twelve months, our data doesn’t show any insider buying. On the plus side, Microchip Technology makes money, and is growing profits. The company boasts high insider ownership, but we’re a little hesitant, given the history of share sales.

Microchip Technology profits

Microchip Technology profits

While we like knowing what’s going on with the insider’s ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To that end, you should learn about the 3 warning signs we’ve spotted with Microchip Technology (including 1 which doesn’t sit too well with us). Learn more.

Of course Microchip Technology may not be the best stock to buy. So you may wish to see this free collection of high quality companies.