Micron Tech Poised for Strong Earnings Amid Surge in Chip Pricing: Analyst

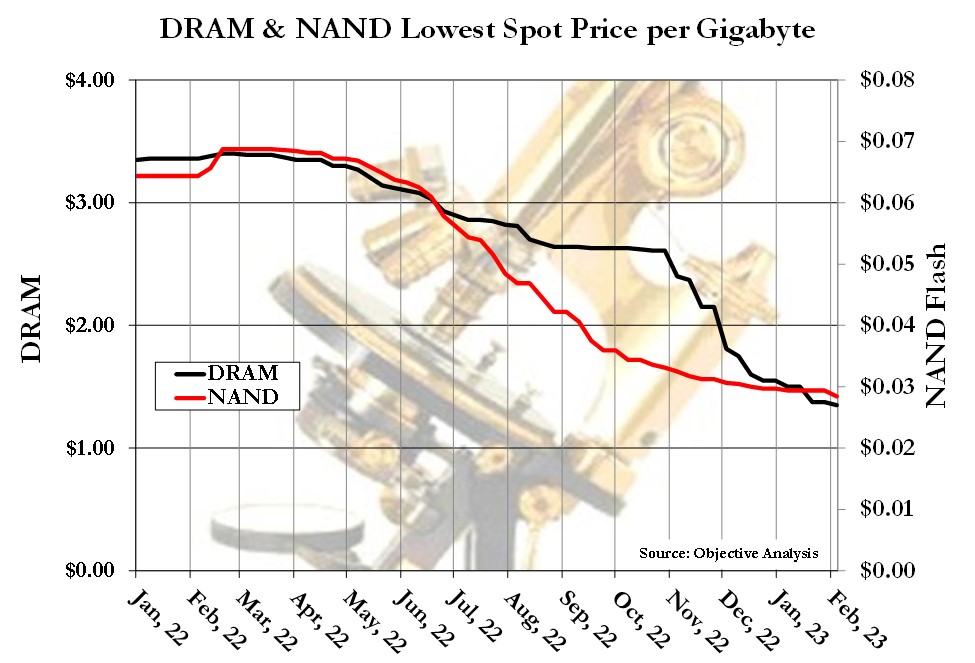

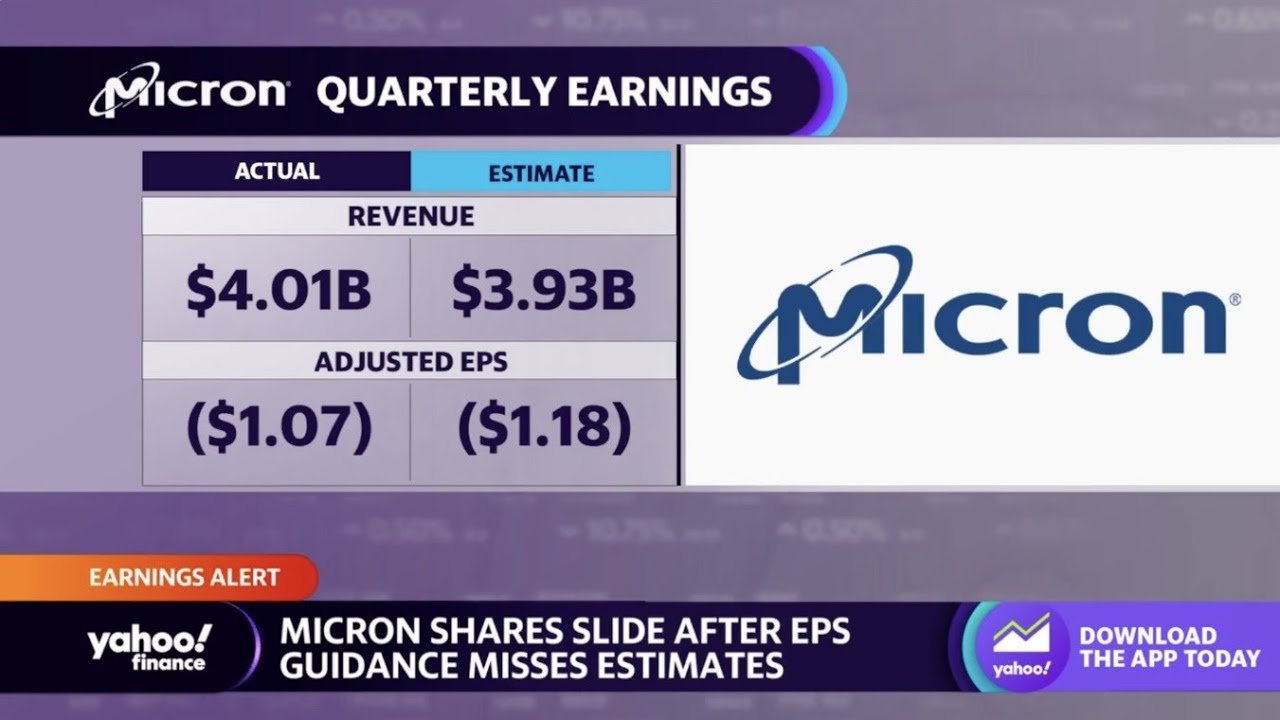

Wedbush analyst Matt Bryson has maintained Micron Technology Inc (NASDAQ:MU) with an Outperform rating and raised the price target from $95 to $103. The company is expected to report its quarterly earnings on March 20, with expectations set high due to the strong movement in DRAM and NAND prices.

Image: Micron Technology

Image: Micron Technology

The analyst said the company will likely exceed its initial guidance, bolstered by higher retail, spot, and forward contract prices than previously forecasted. This optimism is reflected in adjusted estimates for the February quarter, where DRAM and NAND pricing will likely see a significant rise, with DRAM contract Average Selling Prices (ASPs) predicted to increase by nearly 20% in the first quarter and NAND contracts performing even more vital.

Image: DRAM and NAND prices

Image: DRAM and NAND prices

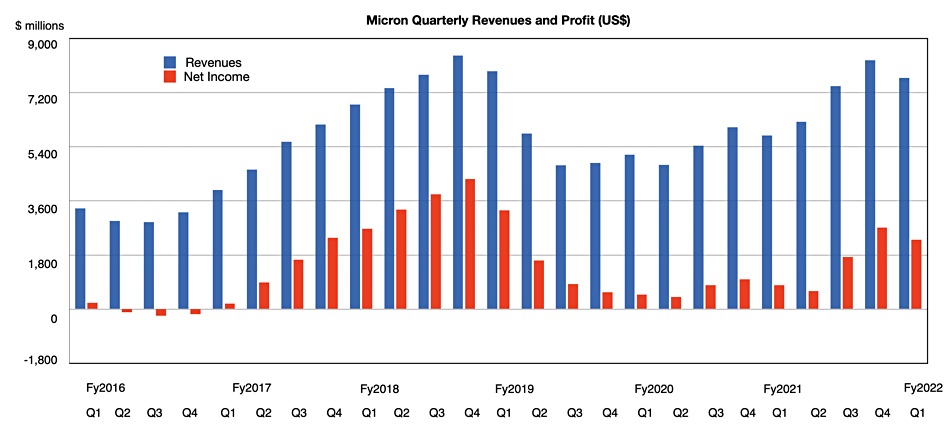

The improved pricing environment suggests Micron’s financial results could reach the higher end of its guidance, possibly even surpassing it. With contract pricing expected to rise by double digits again for both NAND and DRAM in the May quarter, projections for this period have also been adjusted upwards.

Image: Micron’s financial results

Image: Micron’s financial results

Although there’s a cautious approach to the price assumptions for the second half of the year and beyond, anticipating that the current accelerated growth may not be sustained, Micron’s fiscal 2025 Earnings Per Share (EPS) estimates have nonetheless seen a modest increase.

Image: Micron’s EPS estimates

Image: Micron’s EPS estimates

Micron’s gross margin (GM) assumptions for DRAM have been adjusted upwards into the mid-50% range, reflecting an improvement over the last industry cycle in 2021 but not reaching the low 60% levels seen in 2018.

Image: Micron’s gross margin

Image: Micron’s gross margin

This cautious optimism is underpinned by limited recent investments in standard DRAM and NAND production, which may herald a robust memory cycle, and Micron’s enhanced competitive position, likely leading the industry in DRAM cost efficiency and matching peers in NAND quality.

Image: Micron’s competitive position

Image: Micron’s competitive position

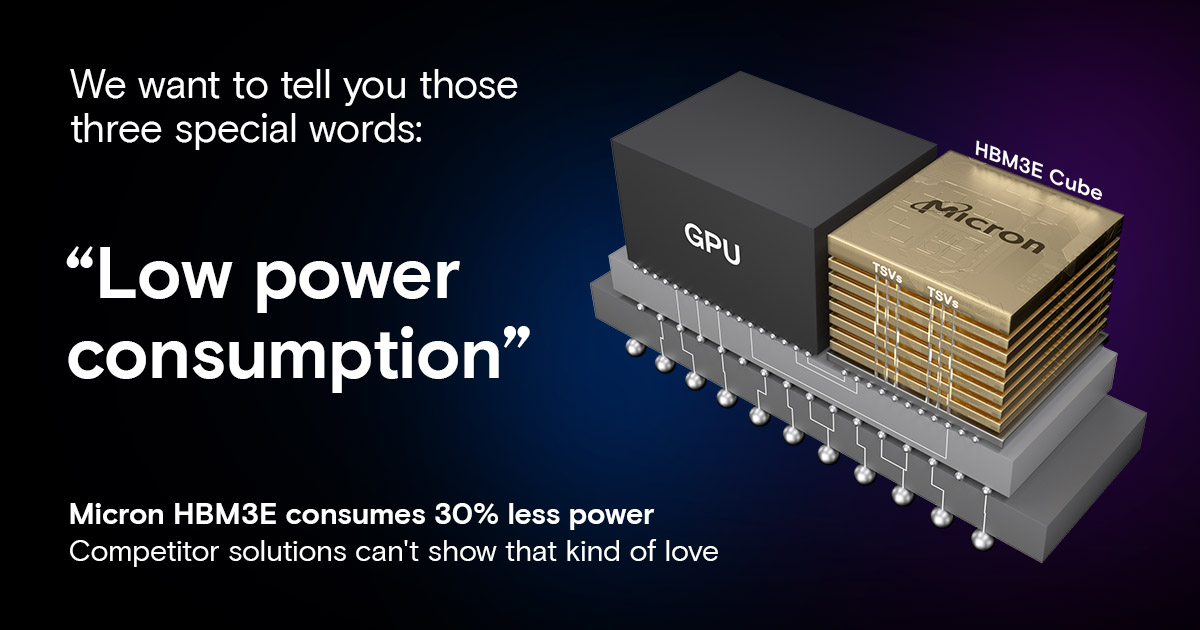

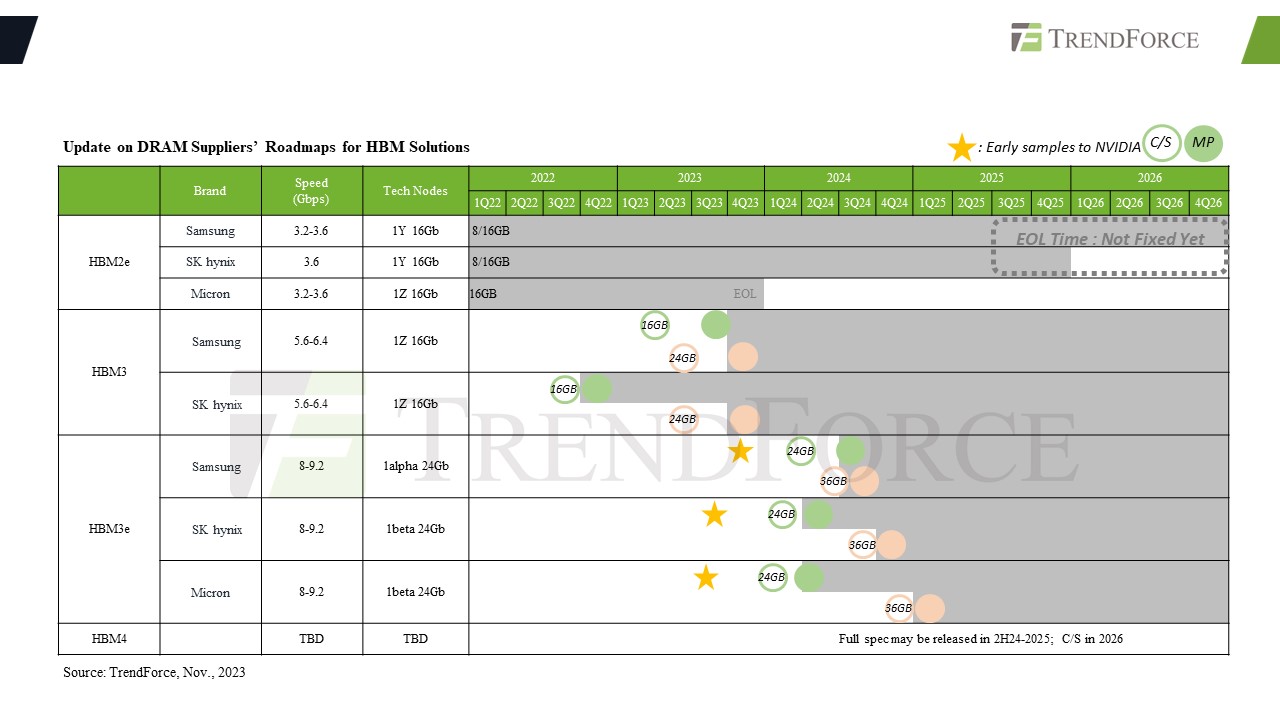

The potential success in ramping High Bandwidth Memory (HBM3e) could also contribute to higher Average Selling Prices (ASPs) and margins.

Image: Micron’s HBM3e

Image: Micron’s HBM3e

Micron’s strategic advancements in High Bandwidth Memory (HBM) are expected to be a focal point, with the company already in production with 8-layer HBM3e and sampling 12-layer parts.

Image: Micron’s HBM

Image: Micron’s HBM

This development aligns with Micron’s ambitious plans for HBM, which are anticipated to boost shipments this year significantly.

Image: Micron’s HBM shipments

Image: Micron’s HBM shipments

Moreover, the analyst added that Micron’s successful penetration into enterprise/cloud accounts and early leadership in 200+ layer NAND production positioned it well to gain market share in upcoming cloud designs despite the competitive landscape.

Image: Micron’s NAND production

Image: Micron’s NAND production

In conclusion, despite potential moderation in PC and handset growth expectations for the upcoming year, Micron’s strategy and competitive positioning, particularly in DRAM and NAND technologies, suggest a strong outlook per the analyst.

Image: Micron’s outlook

Image: Micron’s outlook

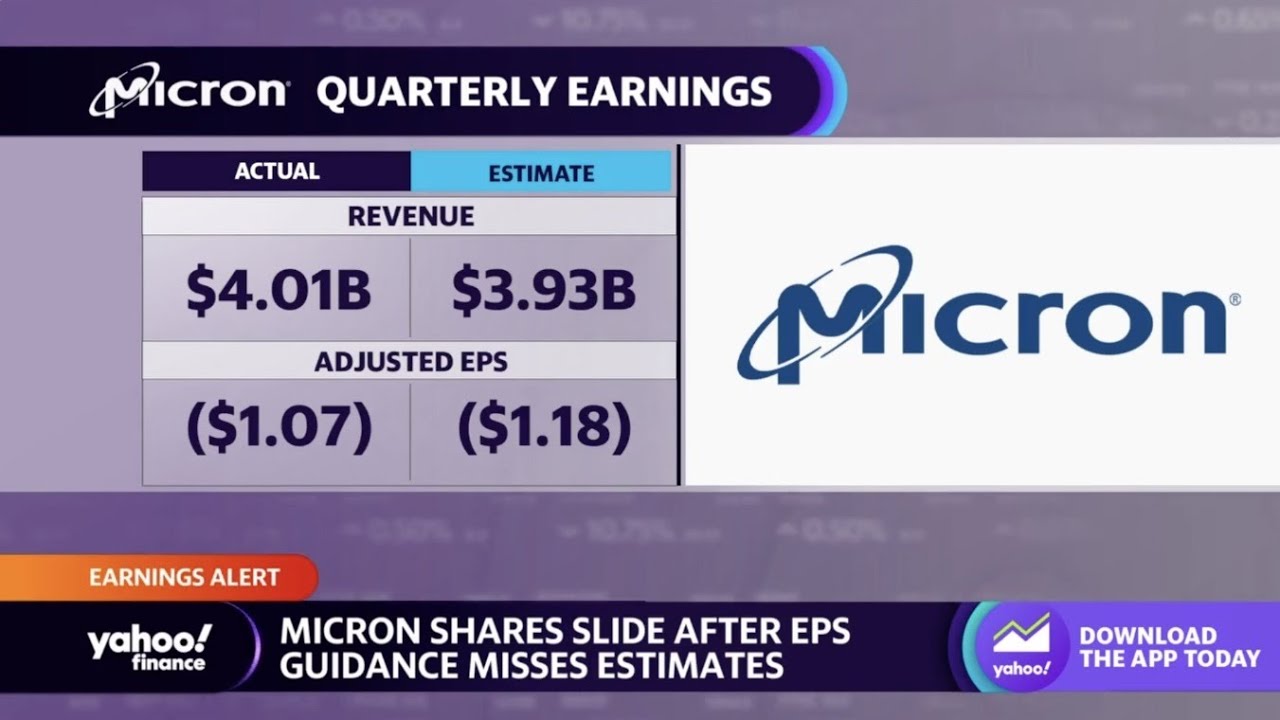

Bryson projects second-quarter revenue and EPS of $5.36 billion (prior $5.3 billion) and $(0.21) (prior loss of $(0.28)).

Image: Micron’s revenue and EPS

Image: Micron’s revenue and EPS

Invesco Semiconductors ETF (NYSE:PSI) and First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) can help investors gain exposure to Micron.

Image: Micron’s ETFs

Image: Micron’s ETFs