Technological Evolution in Finance: The Digital Revolution of Payments and Analytics

The landscape of the financial industry has undergone a dramatic transformation, fueled by innovative technologies that enhance not only operational efficiency but also user experience. From enhanced analytics to automated payment methods, the interconnected world of finance is evolving at an unprecedented pace. This article delves into how changes such as AI, big data, and digital platforms are reshaping finance, with a particular focus on analytics, credit systems, payment solutions, and investment opportunities.

Analytics & Research: Navigating Big Data

In the past, gathering and analyzing financial data was a painstaking process reliant on manual input and traditional metrics. Today, however, the infusion of technologies like big data and artificial intelligence (AI) has revolutionized the landscape. Institutions harness these technologies to analyze vast amounts of data swiftly. This profound shift enables financial analysts to not only discover patterns but also predict future market trends.

The Big Data Revolution

Big data serves as the cornerstone of contemporary financial analysis, enabling real-time assessment of market scenarios. By integrating various data sources—from stock trends to social media sentiment—financial institutions can pinpoint market opportunities and forewarn of potential downturns. These insights lead to more calculated risk assessments, ultimately enhancing stability in an inherently volatile environment.

“Advanced analytics in finance allows companies to make decisions faster and to leverage data in ways that were unimaginable a decade ago,” states financial technology expert, Sarah Kleiner.

Harnessing technology for insightful analysis

Harnessing technology for insightful analysis

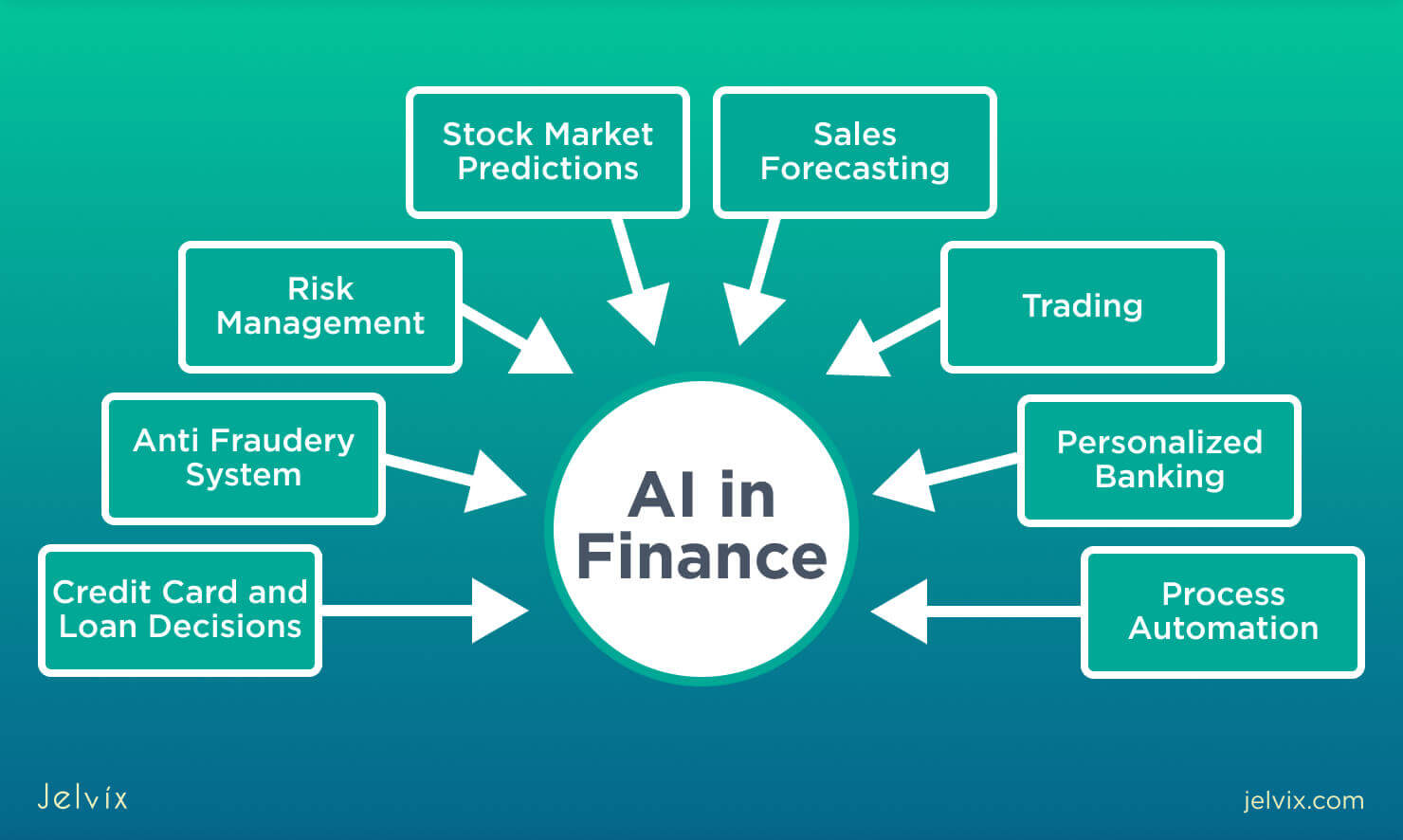

AI and Machine Learning: The New Frontier

Driven by algorithms capable of discerning complex patterns within data sets, machine learning and AI bring a level of analysis once thought impractical. These technologies support trade strategy development and risk management by revealing anomalies and shifts in consumer behavior that human analysts might overlook. Clearly, machine learning stands as a critical pillar in financial decision-making processes.

The Evolution of Credit and Factoring

The introduction of digital platforms has streamlined the credit application process, revolutionizing how consumers approach financial services. Gone are the days of tedious paperwork, as online systems allow for swift credit approvals and digital signatures that enhance user satisfaction and reduce processing times.

Digital Platforms Empower Consumers

Consumers now have tools at their fingertips to compare loan offers with ease. Platforms such as finanzcheckPRO facilitate rapid decisions by providing comprehensive data on various credit options. This upsurge of information empowers consumers, fostering a competitive credit market that benefits borrowers with superior terms and lower rates.

Transforming Payments: The Shift to Digital and Contactless Solutions

As technology advances, so does consumer preference for efficient payment methods. Traditional forms like cash and checks are gradually being overtaken by digital payments, which offer convenience and speed. Mobile payment platforms are now mainstream, allowing users to make swift transactions with a simple tap.

A New Era of Contactless Payments

Companies like Apple and Google Pay have led the charge for mobile transactions, while security enhancements reassure users about the safety of their financial data. As these technologies continue to evolve, it’s clear that the future of transactions is rooted firmly in contactless solutions that prioritize ease and speed.

Digital innovation reshaping payment solutions

Digital innovation reshaping payment solutions

Crowdfunding: Democratizing Investment

Beyond traditional finance forms, crowdfunding has emerged as a powerful tool for aspiring entrepreneurs. Instead of relying on conventional bank loans, innovators and startups can present their ideas to a global audience, gathering small investments that lead to significant funding for projects. This process democratizes finance, allowing anyone with a viable idea to seek backing from the crowd.

Conclusion: Embracing the Future of Finance

As technological advancements redefine the financial landscape, it becomes essential for industry players to not only adapt but thrive amidst the changes. Technologies such as AI, big data, and online platforms are not merely trends; they are the cornerstone of modern finance. These advancements promote efficiency, transparency, and inclusivity, paving the way for a new era that addresses the needs of a digitally-savvy population seeking convenience and security in their financial dealings. With the ongoing evolution in technology, one can only anticipate what the future holds for finance—and how it will shape our engagement with money.

Related Developments in Tech

Meanwhile, tech giants like Google are also making significant strides. The recent enhancements to their search features, which include AI-generated results, reflect an industry-wide move towards integrating advanced technology in everyday services. As Google continues to innovate with features such as AI Overviews and real-time video searches, the intersection of technology and finance will undoubtedly grow even more pronounced.

The fusion of technology across sectors

The fusion of technology across sectors

As we navigate through this transformation, staying informed and adaptable while embracing technological advances remains paramount. The future of finance is bright, and those ready to harness these innovations will be best positioned to lead the new financial paradigm.