The Future of Lithium: Strategic Acquisitions and Revolutionary Tech

Rapid Lithium, formerly known as Armada Metals, has just taken a significant step towards solidifying its position in the burgeoning lithium market by entering into a binding term sheet to acquire New Energy. This agreement signals the company’s strategic intent to consolidate its operations in South Dakota, where lithium assets are gaining critical importance amid rising global demand for electric vehicles and renewable energy solutions.

Expanding horizons in the lithium industry.

Understanding the Acquisition

Under the agreement, Rapid Lithium will issue approximately 59.36 million ordinary shares to Patriot Lithium, the holding company for New Energy. These shares are subject to a voluntary escrow period of 12 months, emphasizing a cautious yet optimistic approach as both companies navigate the complexities of finalizing formal long-form agreements. This acquisition not only complements Rapid Lithium’s recent acquisition of Midwest Lithium but also enhances its strategic focus on hard-rock lithium assets critical for manufacturing batteries used in electric vehicles.

The Black Hills Project, owned entirely by New Energy, includes the Keystone and Tinton West projects located near Rapid City, a region of growing interest for lithium mining. The geographical positioning and existing mineral rights present a lucrative opportunity for Rapid Lithium to expand its operational footprint.

The Market Context

As we dive deeper into the current market landscape, the lithium sector is experiencing a surge in interest from major players due to increasing demand for electric batteries. Countries around the globe are pivoting towards greener technologies, further intensifying the competition for quality lithium resources. Rapid Lithium’s acquisition can be seen as a timely maneuver that reinforces its objectives to emerge as a leader in this space.

Rapid Lithium’s Managing Director, Martin Holland, emphasizes the importance of these strategic acquisitions, stating, > “This acquisition positions the company as one of the leading strategic landholders in South Dakota, US, and sits adjacent to some of the company’s newly acquired assets.” This move indicates a future-oriented strategy whereby Rapid Lithium aims to leverage its holdings as a strategic asset amidst the evolving global energy paradigm.

Emerging Innovations in Wearable Technology

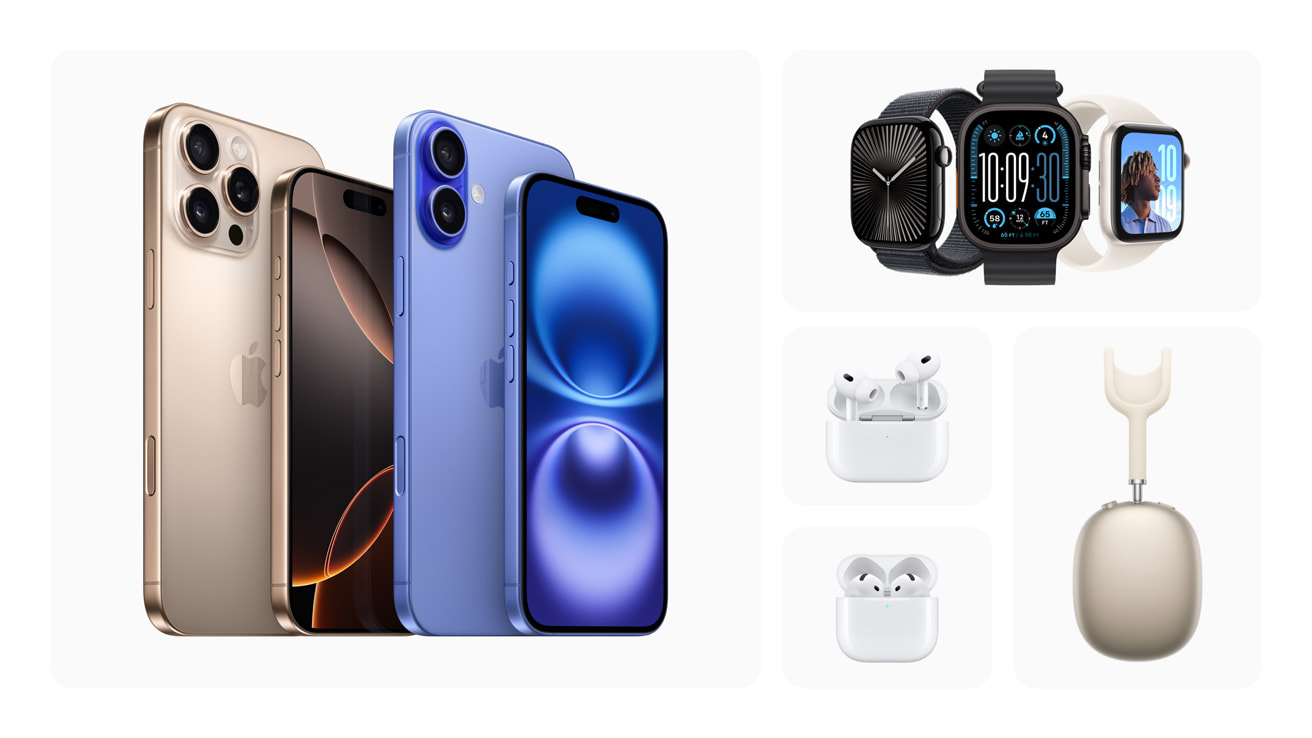

In a parallel development, technology giants like Apple are also strategically positioning themselves for a future dominated by tech-oriented lifestyles. Reports indicate that Apple is working on an exciting array of products set for release as early as 2027, including smart glasses and AirPods equipped with built-in cameras. These advancements reflect a significant leap towards integrating visual intelligence into daily life, enhancing Apple’s ecosystem of interconnected devices that prioritize user experience and innovation.

Apple’s ambitious plans can be compared to the recent trends in the lithium market as both sectors appear to be moving towards sustainable and innovative practices. The anticipated smart glasses, potentially similar to Meta’s Ray-Ban Stories, signify a shift towards devices that not only serve functional purposes but also enhance reality for the average user.

The State of Apple’s Wearable Technology

Continuing on the subject of wearable tech, Apple aims to utilize augmented reality (AR) to transform how we interact with digital information. According to tech analysts, the projected products are expected to deliver features that not only entertain but also inform, offering users a rich, immersive experience. This technological evolution aligns closely with society’s increasing demand for connectivity and efficiency.

Apple’s anticipated release of smart glasses signals a new era.

Apple’s anticipated release of smart glasses signals a new era.

Trends in the Stock Market

While companies like Rapid Lithium and Apple are making waves in their respective markets, the broader stock market’s response has been mixed. Notably, shares of Mercury Ev-Tech Ltd, involved in the electric vehicle sector, have delivered astonishing returns, exemplifying the investor enthusiasm surrounding renewable technology. Over a two-year period, these shares have increased by an astonishing 1518%, highlighting the potential for significant gains in companies positioned within the electric vehicle ecosystem.

However, India’s stock market showed early signs of strain, with indices like the Sensex and Nifty experiencing drops due to foreign fund outflows and concerns over corporate earnings. This fluctuation underscores the volatility within the market, which can be influenced by both domestic and international pressures.

Insights from Recent Market Movements

With Foreign Institutional Investors (FIIs) offloading equities worth approximately Rs 4,888.77 crore, market analysts are on high alert, identifying the need for clarity on consumption trends moving forward. The Reserve Bank of India (RBI) is expected to review monetary policy shortly, which could result in shifts that impact overall market stability.

Conclusion: A Convergence of Industries

The convergence of lithium asset acquisitions by companies like Rapid Lithium and the expansion of tech giants like Apple into wearable technology illustrates a broader trend towards sustainable innovation across industries. Both sectors — mining and technology — are on the cusp of transformations aimed at catering to a future that increasingly prioritizes sustainability and efficiency.

As we watch these developments unfold, heavy investments in strategic assets, whether it be in lithium-rich regions or cutting-edge technology, could redefine market dynamics in the coming years. The implications of these moves are broad, influencing everything from investor strategies to consumer technology adoption. With global attention switching increasingly towards renewable energy and innovative technologies, the stakes could not be higher for both Rapid Lithium and Apple as they propel into the future.

For continuous updates on market trends and innovations in technology, stay tuned to EMA.