The Future is Here: AI, Robotics, and Investment Opportunities in Tech Stocks

In the race to create intelligent machines capable of performing complex tasks, researchers in China have recently made a monumental stride. Scientists at Tianjin University have engineered a robot powered by a lab-grown, artificial brain using human stem cells. This groundbreaking technology, referred to as brain-on-chip, has huge implications for advancements in both robotics and brain-computer interface (BCI) technologies, showcasing the rapid evolution of artificial intelligence (AI).

Breakthrough in AI and Robotics

The innovative characteristics of this brain-on-chip enable the robot to perform fundamental tasks involving object manipulation and navigation. This development reinforces the growing intersection of biologically inspired technology and artificial intelligence. As noted by the researchers, this system represents the “world’s first open-source brain-on-chip intelligent complex information interaction system,” paving the way for future developments in brain-like computing.

“This is a technology that uses an in-vitro cultured ‘brain’—such as brain organoids—coupled with an electrode chip to form a brain-on-chip, which encodes and decodes stimulation feedback.”

In simpler terms, brain organoids are tiny clusters of human-like brain tissue engineered from stem cells. The ability of these organoids to connect with real brain tissues allows for unprecedented opportunities in merging biological intelligence and technological innovation. As industries explore BCI technologies, the potential applications range from therapeutic interventions to enhanced productivity in various sectors.

The merging of human biology with technology demonstrates the leaps forward made in AI and robotic systems.

The merging of human biology with technology demonstrates the leaps forward made in AI and robotic systems.

Financial Markets Eyeing Tech Stocks

The technological advancements in AI do not merely exist in isolation; they translate into investment opportunities for those keeping an eye on the market. Investors are becoming increasingly aware of the potential in companies that are innovating in the technology sector, particularly those involved in AI and robotics. The Zacks Earnings ESP serves as a vital tool for predicting stocks likely to exceed earnings estimates, enabling investors to position themselves strategically.

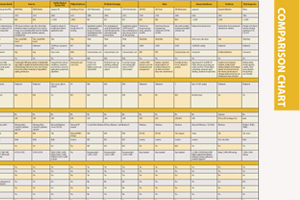

Top Stock Picks: Two stocks currently catching the attention of investors are Shopify (SHOP) and Carrier Global (CARR).

Shopify (SHOP)

Shopify holds a Zacks Rank of #3 and is set to report its earnings soon. The Most Accurate Estimate for the company’s earnings stands at $0.23 per share. Just 30 days before the report, this figure shows an 11.72% Earnings ESP, suggesting a likely positive surprise.

Carrier Global (CARR)

On the other hand, Carrier Global is also positioned favorably, with an earnings release scheduled for July 25, 2024. Holding a similar Zacks Rank #3, Carrier’s Most Accurate Estimate is $0.85 per share, reflecting a minimal difference in its Zacks Consensus Estimate.

These companies represent just a snapshot of how swiftly technology stocks are climbing with the recent developments in artificial intelligence and robotics circuitry.

The landscape of technology stocks is evolving rapidly, influenced by innovations in AI and robotics.

The landscape of technology stocks is evolving rapidly, influenced by innovations in AI and robotics.

Adapting to Change: Market Trends

The rise of AI technology has also led to significant changes in investment patterns. The implications of AI in sectors such as healthcare are notably profound. For example, advanced imaging technologies, including computed tomography (CT), are witnessing robust advancements, improving diagnostic accuracy and patient outcomes. This reflects not only on investments in health tech but also quality of care and patient engagement.

Recent studies from leading health policy institutes indicate an ongoing transformation in how medical imaging is conducted, with a significant portion being interpreted by non-radiologists, further emphasizing the diversification of roles in healthcare environments.

New Ventures in Medical Imaging

Companies are increasingly focused on integrating AI solutions that enhance imaging performance and predictive analysis in clinical settings. Collaboration agreements, like those between Proscia and Nucleai, are enabling access to advanced AI predictive biomarkers, underlining the relentless pace of innovation.

Industry Cooperation for Growth

As industries ignite with cooperation in technological advancements, partnerships like these highlight the synergies that can be fostered for mutual benefit and growth. Essential medical advancements, such as precision radiation therapy for lung cancer, signal a new era of personalized healthcare, made possible by the integration of AI tools.

As the pace of AI development quickens, staying informed about the associated investment opportunities in technology stocks remains crucial. With the Zacks Earnings ESP Filter, investors can seek out stocks poised for earnings surprises, enhancing their strategies as they navigate through profit avenues before earnings season.

Healthcare advancements are rapidly adopting AI technologies, positioning new paradigms in medical imaging and treatment.

Healthcare advancements are rapidly adopting AI technologies, positioning new paradigms in medical imaging and treatment.

Conclusion: Navigating the AI and Technology Revolution

The fusion of AI, robotics, and advanced computing represents a seismic shift not only in technological capabilities but also in how investment strategies can be crafted in response. As 2024 unfolds, tech-savvy investors must pay close attention to the evolving landscape marked by powerful innovations such as lab-grown artificial brains, advanced imaging systems, and the continuous integration of AI into industry practices. The possibilities are vast, and the rewards are potentially game-changing for those willing to embrace this technological revolution. Keep your stocks list ready and stay informed, as the future of investing in technology is now.