Sensteed Hi-Tech: A Lithium Stock Set to Soar with 131% Resource Boost

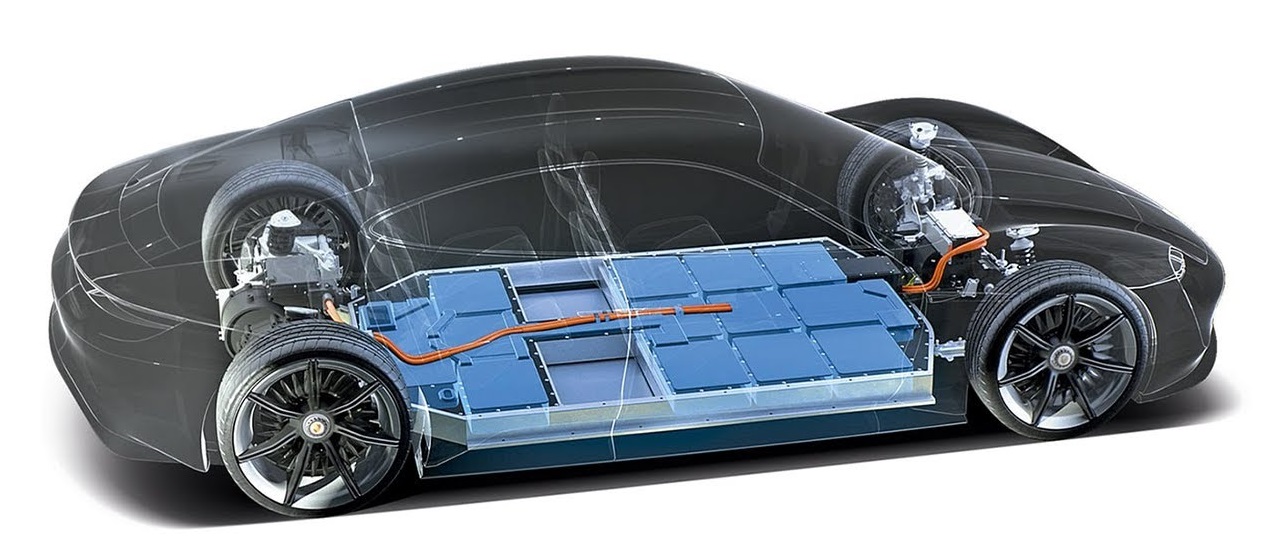

In an impressive turn of events, Sensteed Hi-Tech has more than doubled its lithium resource by 131%, now boasting a staggering total of 11.24 million tonnes. This revelation comes as lithium continues to be a focal point in the global energy market, driven by the demand for battery technology, particularly in electric vehicles.

The emerging trends in lithium resources.

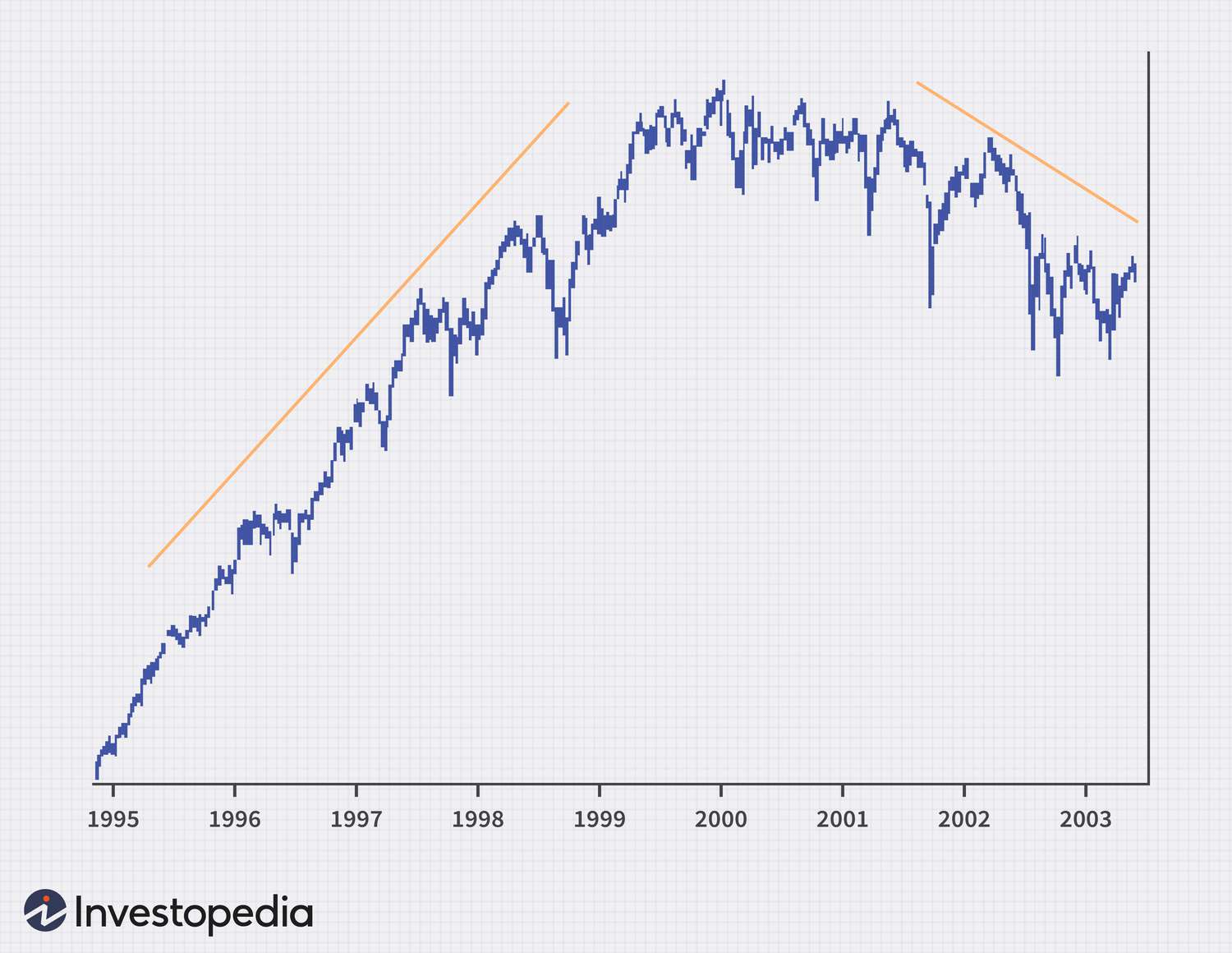

Despite the heightened resource figures, the company’s stock is currently priced at 1.05 CNY. However, the market sentiment is clouded by its recent performance, with deviations from key moving averages raising eyebrows. Specifically, Sensteed’s stock shows a -5.49% deviation from its 50-day moving average, and an even more concerning -24.13% from the 200-day average. Such discrepancies have resulted in a ‘poor’ short-term rating. The market is keenly observing how Sensteed will navigate these challenges.

Market Sentiment and Stock Discussion

Interestingly, recent analyses reveal a generally positive outlook among investors in social media discussions surrounding Sensteed Hi-Tech. The chatter is largely upbeat, emphasizing optimistic developments with little to no negative feedback, which signals a potentially strong support base.

“The discussions highlight a positive investor sentiment towards Sensteed, a crucial element as they look to stabilize their stock performance.”

Furthermore, metrics assessing the discussion strength in social media show a lack of significant activity over the past four weeks, reinforcing a neutral rating in terms of public engagement. This suggests that while investors remain optimistic, their enthusiasm isn’t translating into increased trading activity just yet.

Rise of electric vehicle demand driving lithium trends.

Rise of electric vehicle demand driving lithium trends.

Analyzing the Broader Market

Sensteed Hi-Tech’s trajectory is part of a broader narrative in the lithium market, which is witnessing unprecedented demand driven primarily by the electric vehicle sector. Major automotive manufacturers are transitioning towards electric platforms, underpinning the soaring need for lithium-ion batteries. Analysts expect that as the market adjusts, stocks like Sensteed could experience a renaissance.

The critical factor will be whether the company can leverage its newly increased resource base effectively. As seen historically, companies able to capitalize on resource abundances during surges in market demand often see their valuations increase significantly. Currently, Sensteed’s market capitalization is $168.6 billion, making it 3,891 times its stock value.

Future Outlook

As we look ahead, the key questions remain: Can Sensteed Hi-Tech turn sentiment into action? And how will the company manage its resources as global demand for lithium spikes? These factors will ultimately dictate the company’s trajectory in a highly competitive environment.

For investors, the present moment might be seen as a waiting game, with the thrill of the upcoming lithium boom hanging in the balance. Sensteed’s ability to navigate these waters will be critical to its survival and growth.

Essential trends driving lithium investments.

Essential trends driving lithium investments.

Related Articles

In conclusion, while Sensteed Hi-Tech faces immediate challenges reflected in its stock performance, the silver lining is its strong resource base and positive investor sentiment. The road ahead is filled with potential, but it will take strategic moves forward to truly capitalize on the current market dynamics.