Netflix and Amazon: The Streaming Titans Reinventing Originals

The landscape of streaming originals continues to be reshaped as Netflix and Amazon emerge as dominating players in the space. A recent report from Ampere Analysis reveals that these two giants accounted for a staggering 53% of all SVoD (Subscription Video on Demand) commissions globally in the first quarter of 2024, marking a significant resurgence in their original content commissioning.

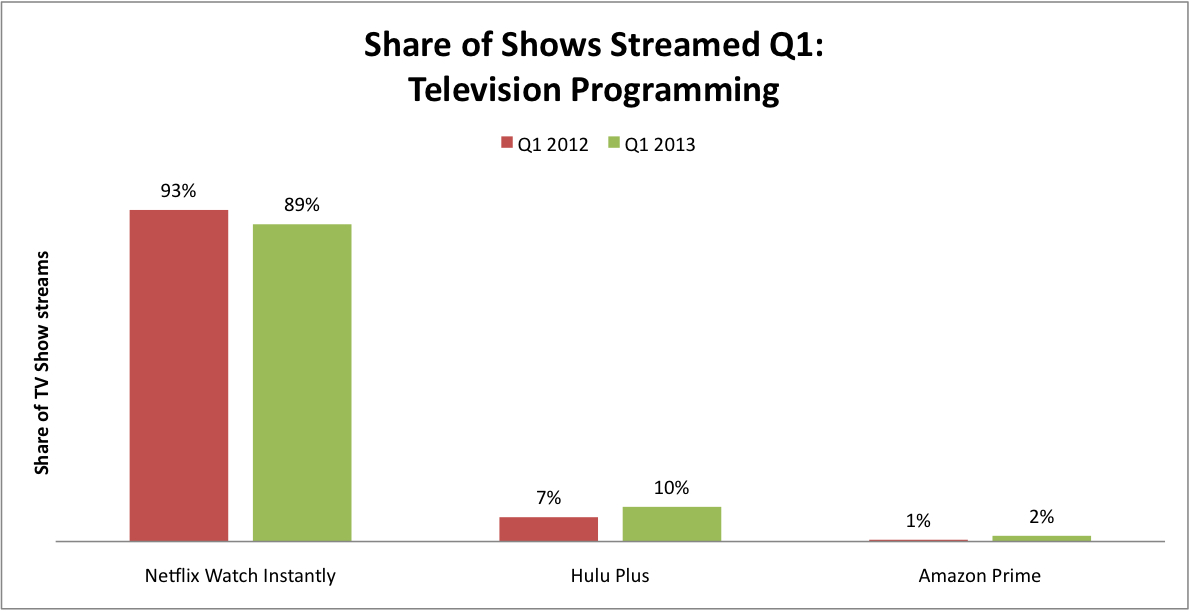

An overview of the streaming giants in Q1 2024.

An overview of the streaming giants in Q1 2024.

In a period where many competitors have become cost-conscious and reduced their commissioning, Netflix’s output surged, hitting the highest number of new titles since Q3 2021. Simultaneously, Amazon also set a quarterly record, showcasing not just resilience but aggressive growth strategies in the face of adversity from rival services.

International Expansion: The Key to Growth

Both platforms have pivoted towards an international strategy, increasingly sourcing content from outside the United States. This shift is a calculated move to mitigate stagnating domestic subscriber numbers. Ampere’s report highlights that Netflix’s commissioning from Western Europe has accelerated, nearly matching its North American titles, while Asia Pacific regions are witnessing a notable rise in content orders.

In particular, Netflix is capitalizing on markets like Spain, India, and South Korea, focusing on dependable content providers that can appeal to global audiences. In Western Europe, countries like the UK, Spain, and Germany have become central to Netflix’s commissions, with unscripted content seeing significant growth—documentaries now comprise 30% of the region’s orders, up from 23% year-over-year.

The rise of global streaming content.

Conversely, Amazon is taking a decisive stance in India, unveiling a record 37 titles from the region, which is more than the combined total of the previous six quarters. This significant increase not only positions Amazon to compete more effectively against local platforms but also emphasizes India’s emerging status as a pivotal market in its global strategy.

The Rise of Local Productions

Both platforms are also refocusing their strategies towards producing local content. In Q1 2024, Amazon’s commissions in Germany outpaced those in other traditional markets, reflecting a shift in priorities. Germany emerged as a standout region with 13 content orders, nearly doubling its previous high from 2021. This emphasis on localized content indicates a broader trend where streamers look to harness regional strengths to drive subscriber growth.

Quoting Mariana Enriquez Denton Bustinza, Senior Researcher at Ampere Analysis:

“The market saturation in North America, the growing cost of production, and the lingering impact of the Hollywood strikes have pushed Netflix and Amazon to increase investment in international productions to stimulate subscriber growth.”

Shifting Strategies Amid Economic Pressures

As production costs rise and competition heats up, both platforms have had to rethink their content acquisition strategies. Netflix, for instance, is decreasing its domestic commissioning of original movies, instead opting for pay-one agreements with theatrical studios to secure new exclusive US films. This shift allows them to focus on international movie orders, especially in regions like the Nordics and Sub-Saharan Africa.

Meanwhile, Amazon’s approach is distinctly focused on facilitating localized content through co-financing deals with regional distributors. Their successful acquisition of MGM has empowered them to expand their reach significantly, resulting in the commissioning of more films than Netflix for the first time in Q2 2023.

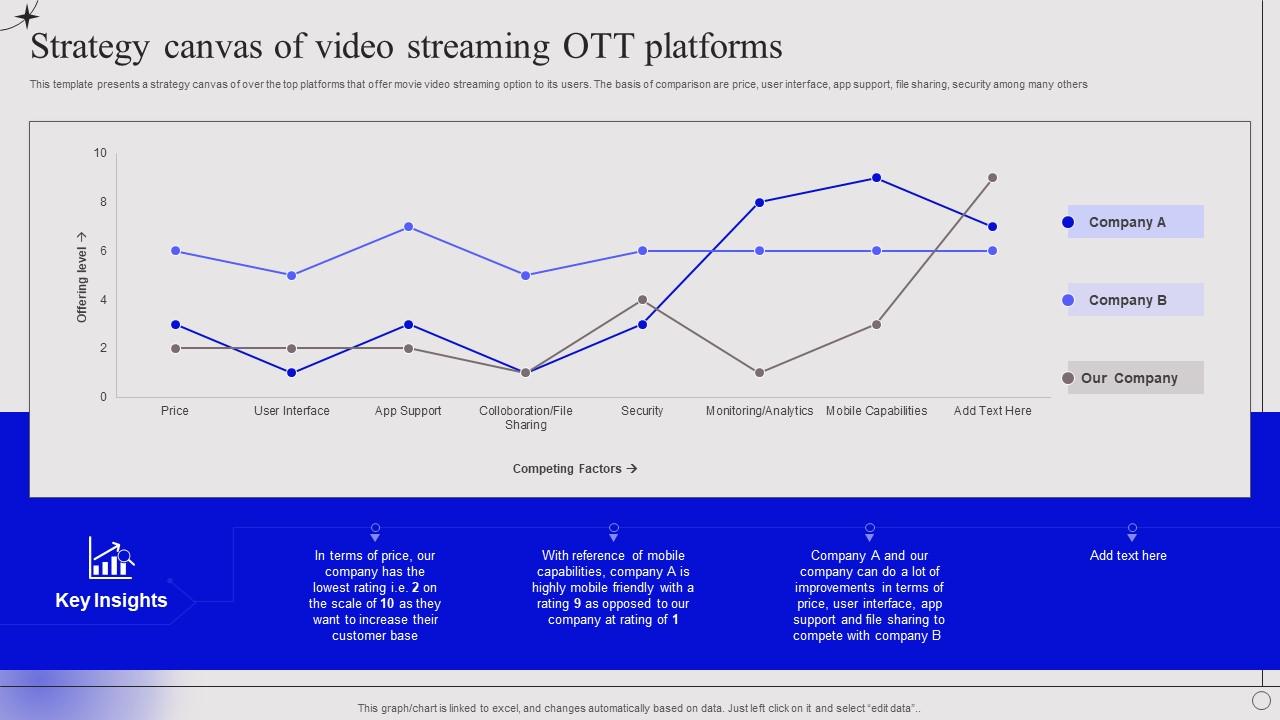

Comparative analysis of streaming strategies.

Comparative analysis of streaming strategies.

Conclusion: The Road Ahead for Streamers

With the streaming industry continuously evolving, Netflix and Amazon are strategically positioning themselves as the go-to platforms for diverse and international content. As they navigate the challenges posed by a saturated North American market, their focus on localized global strategies appears to be a promising approach to maintain subscriber engagement and growth. The next few quarters will be pivotal in seeing whether this strategy pays off across the ever-competitive landscape of streaming.

As content consumption becomes increasingly globalized, the importance of localized production will only continue to grow, potentially redefining the future of how streaming services operate on a worldwide scale.