Tech Stocks in Turmoil: Assessing the Impact of Recent Economic Data

The financial landscape has experienced a tumultuous shift as Wall Street responds to the latest economic indicators that suggest a slowing momentum. In a climate ripe for discussion, we delve into what the latest economic data mean for tech stocks and corporate America at large.

Markets facing uncertainty following economic reports.

Markets facing uncertainty following economic reports.

Just a day ahead of the Federal Reserve’s favored inflation measure, a report revealed that the U.S. economy expanded at a softer pace, sparking concerns among traders. The latest figures displayed a marked decrease in both consumer spending and inflation, igniting speculation regarding potential interest rate cuts later this year. Yet, while lower rates could bolster economic activity, a concern arises: what does this imply for the overall consumption and corporate profitability?

Chris Zaccarelli from Independent Advisor Alliance noted, “The economic data today are a double-edged sword.” Indeed, while we hope for the Federal Reserve’s intervention, the possibility of a declining consumer base looms large. Investors often extrapolate economic growth from stock valuations, and any sign of weakness can trigger a sell-off, especially in sectors dependent on consumer activity.

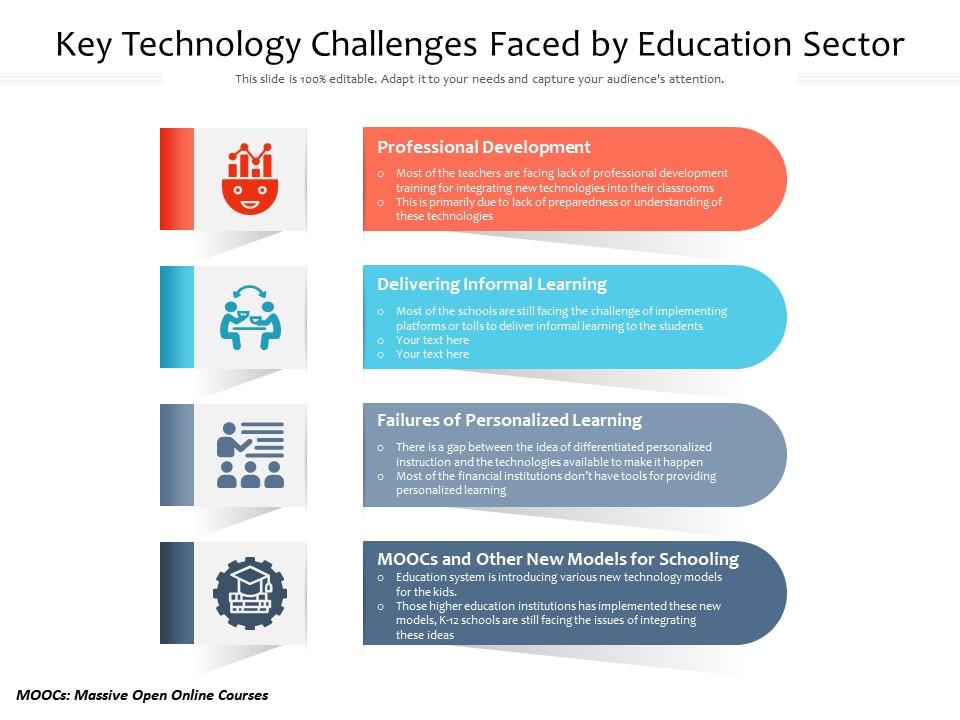

The Technology Sector and Regulatory Hurdles

In the tech sector, the S&P 500 index felt the brunt of this negative sentiment, dropping to 5,235, with technology stocks leading the decline. Notably, U.S. officials have restricted licenses for chip manufacturers like Nvidia and AMD, impacting their ability to ship large-scale AI accelerators to the Middle East. This regulatory setback has reverberated through the tech ecosystem, leaving investors rattled and tech stocks tumbling.

Challenges for semiconductor companies in the current landscape.

Challenges for semiconductor companies in the current landscape.

Adding fuel to the fire, Dell Technologies saw its stock plunge as the latest revenue reports failed to meet market expectations. As production ramps down in response to these market forces, I can’t shake the dread that we might be witnessing the precursor to a significant market correction, particularly for companies tightly woven into the tech supply chain. Economic cooling, after all, could signal the beginning of a difficult recovery path for the nascent recovery the tech industry enjoyed.

Bond Market Reactions

Interestingly, as tech stocks plunged, unlike the equities market, the bond market exhibited a contrasting trend. Treasury two-year yields dipped by five basis points, suggesting a flight to safety as investors seek refuge from volatility. The dollar weakened, indicating a broader market reaction to the economic news that sparks uncertainty. Navigating this duality has left many investors in a bind, trying to assess where opportunities remain amidst a growing backdrop of caution.

Mike Zigmont from Harvest Volatility Management shared his perspective: “At the time it was out, I wasn’t worried. Futures were still trading, so you could use them to get the SPX level.” This resilience in futures trading provided a lifeline for many traders caught off guard by the glitches affecting live pricing of key indices. It’s a good reminder of the adage that in chaos, opportunities can arise for those prepared to act.

Economic Forecasts and Market Sentiment

Looking forward, it would be a mistake to underestimate the implications of this latest economic dataset. The Federal Reserve has previously indicated its belief that inflation will continue to decline in the latter half of the year. John Williams from the Fed has suggested that elevated borrowing costs are indeed weighing down the economy, making it essential to reassess our expectations for growth and profitability across various sectors. Zaccarelli posits that while interest rates and economic health are interconnected, the ultimate focus should be on sustained economic expansion and corporate profit growth—factors that appear more vital than mere rate cuts.

Analysts sharing insights on future economic trends.

Analysts sharing insights on future economic trends.

As we analyze the latest GDP numbers, which revealed an annualized growth of 1.3%—down from an earlier estimate of 1.6%—it becomes clear that the main growth engine of personal spending has also dimmed, increasing by only 2.0%. Jim Baird from Plante Moran remarked, “Sum it all up and you have an economy that has come off the boil—and needed to—but remains on track for continued growth.” This nuanced perspective offers a glimmer of hope amidst the downturn, suggesting that while we may experience turbulence, economic fundamentals still point to potential growth ahead.

Inflation – A Persistent Challenge

Inflation continues to plague consumers and policymakers alike as it shapes market sentiment leading into upcoming reports, such as this Friday’s personal consumption expenditures index. Chris Larkin at E*Trade notes, “The name of the game is still inflation and interest rates.” The upcoming PCE report is likely to set the tone for market attitudes, shaping not only investor confidence but also the Fed’s positioning. The focus remains on balancing these elements which may dictate when and how aggressively the Fed can act.

This period of uncertainty has sparked a blend of optimism and caution. In a landscape marked by regulatory headwinds, fluctuations in technology investments, and a heavy reliance on economic indicators, my personal belief remains that adaptability is vital. For investors, the ability to pivot and reassess strategies in the face of turbulence will be key, shaping how we navigate these complex financial waters.

In conclusion, as traders brace for the next round of economic data, one must consider that while the signs of a cooling economy are evident, they also pave the way for potential opportunities. After all, navigating fluctuations may just lead to discovering the hidden gems within this evolving market environment.