The Future of Finance: Merging Traditional Finance with Blockchain Technology

The world of finance is undergoing a significant transformation, and at the heart of this change is the integration of traditional finance (TradFi) with blockchain technology. This was the central theme discussed at a recent panel discussion at Money20/20, where industry experts explored the evolution of blockchain technology and its security implications on the emerging market.

Blockchain technology is changing the game

Blockchain technology is changing the game

According to Ioana Surpateanu, co-founder of Domin Network, “Blockchain helps optimize and attract consumers in creative industries. The coexistence of TradFi and blockchain is already a reality and will continue to evolve.” Surpateanu emphasized the importance of interoperability, stating that it prevents fragmentation in blockchains and fosters innovation.

The panelists highlighted the need for centralized exchanges as a way to secure platforms for retail and institutional customers to engage with crypto. Reflecting on the past year, the panel delved into the substantial growth of the crypto market, especially in the blockchain market.

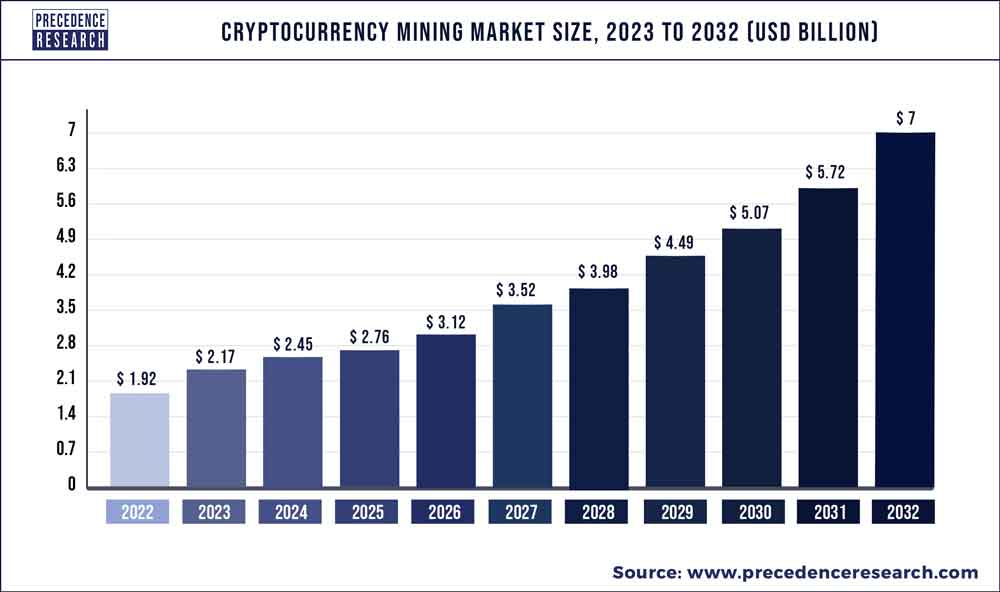

The crypto market has seen significant growth

The crypto market has seen significant growth

Surpateanu is focused on developing a technology that validates and authenticates data across different blockchain layers, allowing users to exchange digital items for physical ones – like tokenization. Many fashion and gaming companies are showing great interest in this technology as it helps them gather valuable insights and strengthen their user communities.

Kaushik Sthankiya, from Kraken, further highlighted the growth of the crypto market, stating, “Crypto has matured significantly over the past twelve years. We now operate in 190 countries, offering over 200 tokens for trading. The safety, security, and regulatory compliance in the industry have vastly improved.”

Kraken’s growth in the crypto market

Kraken’s growth in the crypto market

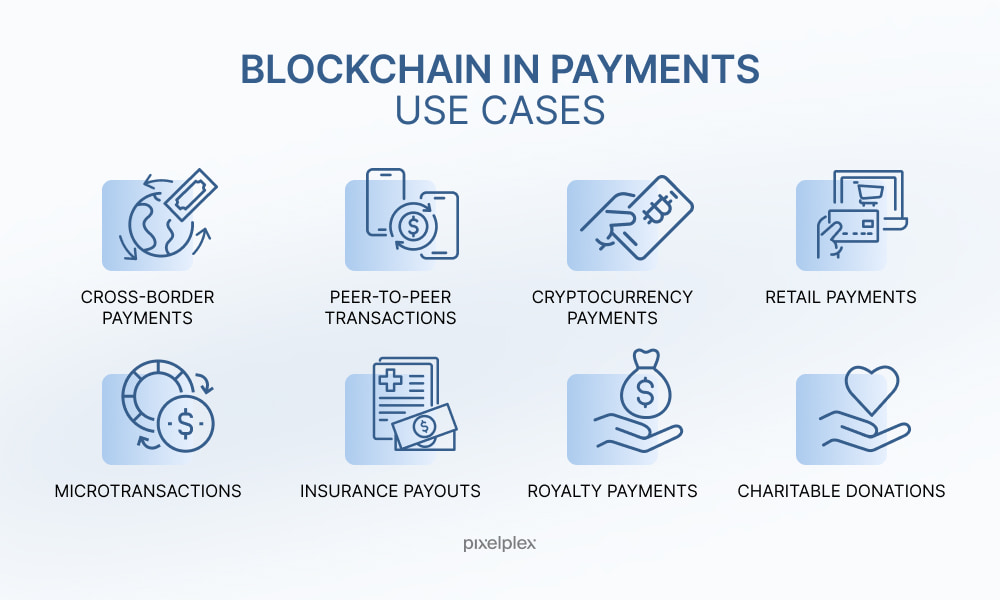

The conversation then turned to the practical applications of blockchain in payments. Cassie Craddock, from Ripple, shared how cross-border payments have become faster and more efficient. “It’s quicker to fly money to Australia than to send an international wire. Blockchain technology addresses this inefficiency,” Craddock stated.

Blockchain technology in payments

Blockchain technology in payments

Sthankiya highlighted Kraken’s role in facilitating large-scale transactions. He explained that institutional customers have a growing demand for the instant movement of substantial amounts of money worldwide, and the safety and security provided by centralized exchanges are paramount in meeting this demand.

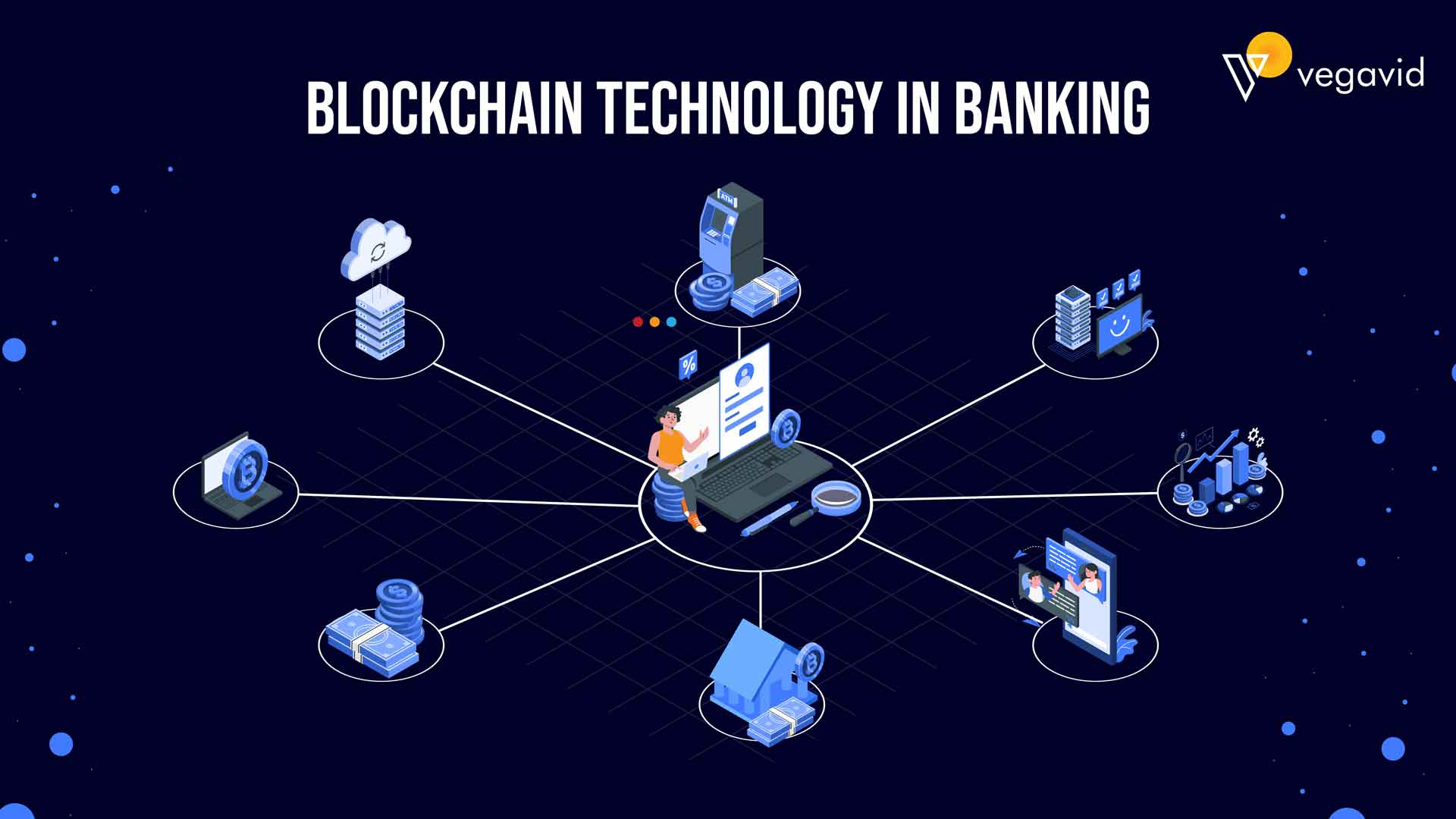

Surpateanu also provided a critical viewpoint on banks’ integration with blockchain. “Banks could do more to integrate into this ecosystem. While there are talented crypto-savvy teams within banks, regulatory concerns and a compliance-driven mentality often hold them back,” she said.

Banks and blockchain integration

Banks and blockchain integration

In conclusion, the integration of traditional finance with blockchain technology is crucial for the future of finance. As the crypto market continues to grow, it is essential to address the importance of interoperability, security, and regulatory compliance. The future of finance is exciting, and it will be shaped by the convergence of TradFi and blockchain technology.

The future of finance is exciting

The future of finance is exciting