The Power of Data-Driven Insights in Credit Unions

As a credit union professional, you have the unique opportunity to make a meaningful impact on people’s financial lives. The way you engage with your members, whether directly or indirectly, can make all the difference in their financial well-being. In today’s financial health crisis, where many Americans struggle with their finances, credit unions are reshaping how they operate, and members are changing how they spend, save, borrow, and invest.

The financial health crisis affects many Americans

The financial health crisis affects many Americans

By providing the tools, resources, and support your members need to improve their financial well-being, you can help change their lives for the better. To better serve your members as well as your back office, consider the power of data-driven insights:

- Personalization: Data-driven insights allow for personalized recommendations tailored to each member’s financial situation, goals, and behavior.

- Improved member experience: By understanding members’ needs and preferences, you can enhance their overall experience, leading to higher satisfaction and loyalty.

- Risk management: Analyzing data can help you identify and mitigate potential risks for members and your organization—like identifying a member who’s at risk of defaulting on a loan.

- Product development: Insights from data can help inform the purchase or development of new products and services that better meet the needs of your members, leading to increased engagement and revenue.

“The way you engage with your members—whether directly or indirectly—can make all the difference in their financial well-being.”

At the heart of data-driven insights is the need for personal connection. Your ability to make members feel known, understood, and valued is key. By offering personalized experiences and listening to their individual needs, you can foster trust and credibility that sets you apart.

Personal connection is key to member satisfaction

Personal connection is key to member satisfaction

To unlock these valuable insights, enabling ecosystem growth is crucial. An expanded ecosystem can facilitate the strategic relationships you need to enhance data-sharing capabilities and allow for the collection of diverse data points from various sources.

Ecosystem growth enables data-driven insights

Ecosystem growth enables data-driven insights

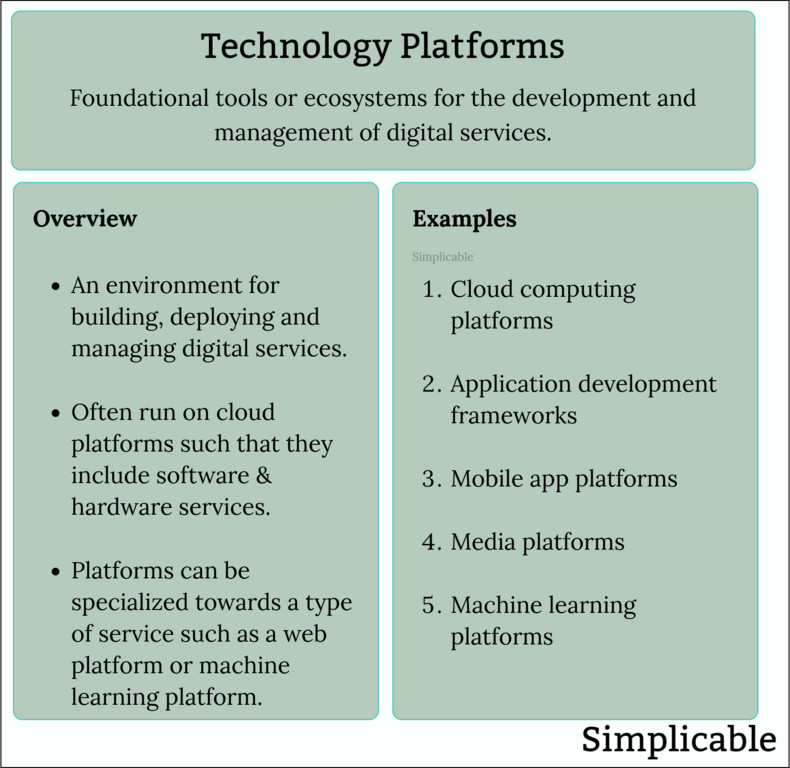

To build a successful ecosystem, it’s essential that your technology platform is open to integration with no barriers—financial or otherwise. It should also have clear design standards to help you standardize your brand experience. To stay successful in a time when the lines of competition are blurred, it’s important to prioritize developers and high-grade fintech partnerships by leveraging a technology platform that supports such partnerships.

A technology platform that supports fintech partnerships is crucial

A technology platform that supports fintech partnerships is crucial

As you consider what’s worth investing in, remember that your members are counting on you. By putting people first, unlocking member insights, and enabling ecosystem growth, you can build a stronger, more resilient credit union that truly makes a difference in the lives of your members.

A successful credit union makes a difference in members’ lives

A successful credit union makes a difference in members’ lives

To learn more about how you can keep (or reclaim) your role at the center of people’s financial lives using future-ready technology, read Connecting Possibilities.