Wall Street Sets the Stage: Are Lower Earnings Expectations a Blessing in Disguise?

Wall Street is bracing itself for an earnings season that may well challenge expectations, as analysts have dialed back their forecasts for third-quarter earnings amid signs of a slowing U.S. economy. The consensus suggests that the S&P 500 could see its growth slow to 4% — a noticeable decline from 11% in the previous quarter. Despite these ominous indicators, some experts are optimistic about the potential for stocks to outperform the lowered expectations.

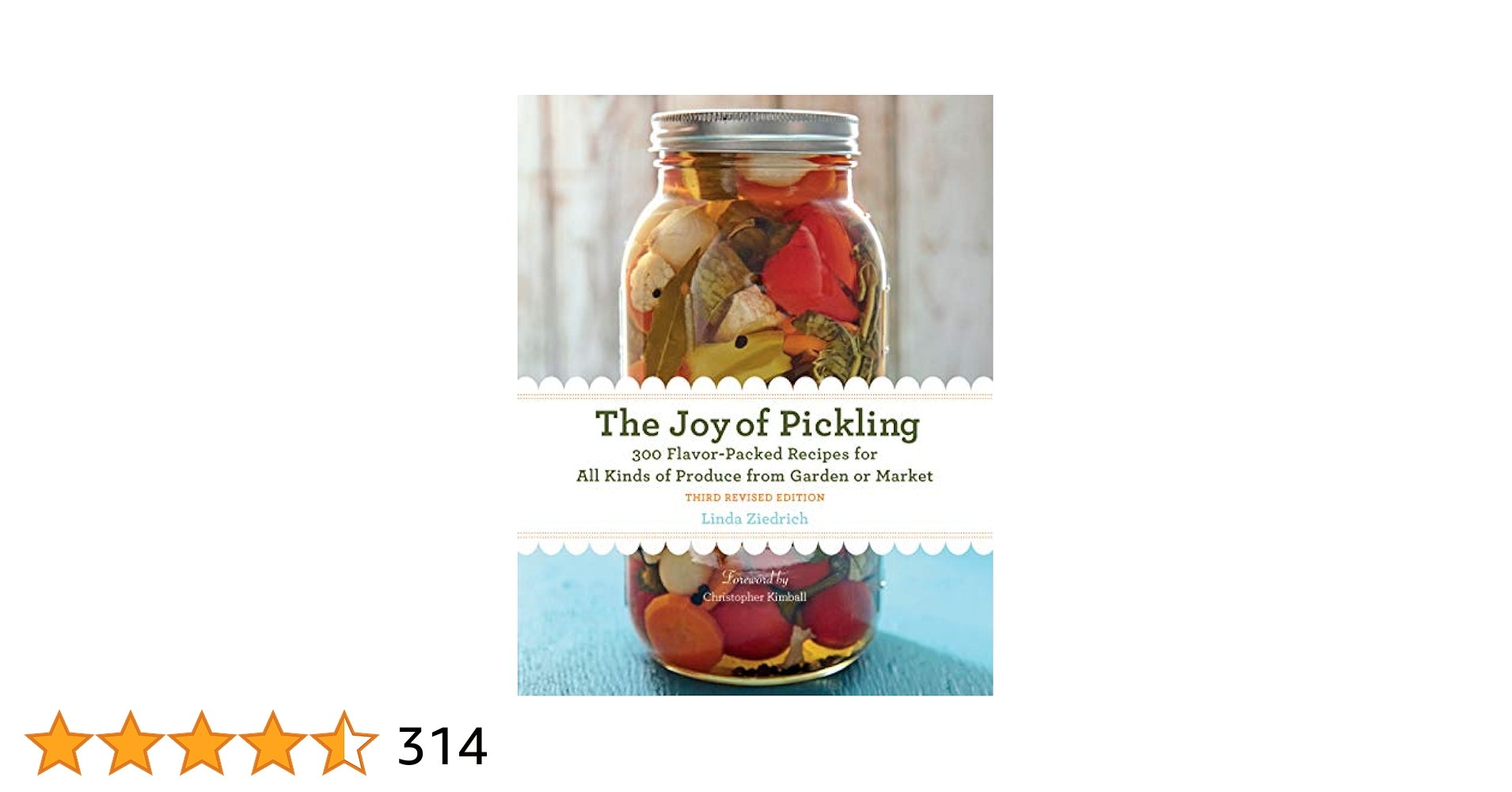

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2171693005-a19fa66c488c455baf8648603c7751e3.jpg) Earnings season begins amid cautious expectations.

Earnings season begins amid cautious expectations.

According to analysts at Bank of America, the adjustments made to earnings forecasts have been more substantial than usual, with a total reduction of nearly 4% throughout the quarter. This figure is notably above the averages from the last 5, 10, and 15 years. However, the tech sector is a bright spot experience an upward adjustment in expectations, presenting an intriguing juxtaposition to other industries.

A Low Bar for Performance

The reduced benchmarks could prove beneficial for investors, opening opportunities for stocks to exceed forecasts and generate positive surprises. As pointed out by Bank of America’s analysts, sectors may see favorable rewards if companies can showcase resilience in navigating macroeconomic challenges. They state,

“As long as companies have managed through macro headwinds and see early signs of improvement from lower rates, stocks should get rewarded.”

They project that S&P 500 earnings may surpass estimates by approximately 2 percentage points, setting an optimistic tone amidst prevailing uncertainties.

Recent reports show that S&P 500 firms have been beating earnings estimates at a rate exceeding historical averages, with over 75% surpassing their projected earnings per share. Even more promising, these firms are outpacing the previous quarter by a wider margin — 3.5% compared to 1.7%. However, it’s worth noting that only 21 companies had reported earnings at the time of this assessment, and thus a cautious approach should be adopted.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2171693005-a19fa66c488c455baf8648603c7751e3.jpg) Market trends show volatility ahead.

Market trends show volatility ahead.

The Impact of Rate Cuts

With the Federal Reserve commencing an easing of monetary policy, a renewed sense of optimism surrounds the earnings outlook. In sectors most sensitive to interest rates, including manufacturing and housing, expectations are rising that declining rates could initiate recovery, providing a lift to overall S&P 500 profits. BofA highlights that approximately half of the index’s profits stem from goods-focused businesses, despite their representing only 20% of U.S. GDP.

Capital Expenditures: A Mixed Bag

Moreover, forecasts around capital expenditures (CapEx) suggest that companies may increase spending to boost productivity, especially in cutting-edge sectors like artificial intelligence. High-profile tech entities like Microsoft, Amazon, and Alphabet are projected to invest upwards of $200 billion in infrastructure this year, heavily focusing on AI initiatives. This investment strategy had previously caused some investor hesitance, rearing concerns around heavy expenditures in the past quarter.

However, this potential surge in spending may pave the way for greater revenue streams across technology and industrial sectors. In stark contrast, other S&P 500 companies are set to curtail CapEx by about 1% this year as high borrowing costs weigh on expenditure decisions.

As noted by BofA, investment activity typically rebounds post-elections when executives gain clearer visibility on taxation, trade, and regulatory landscapes. This post-election revival may be magnified in 2024 by softening interest rates, offering a promising horizon for growth, should these declines continue.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-2171693005-a19fa66c488c455baf8648603c7751e3.jpg) Projections indicate potential for economic rebound.

Projections indicate potential for economic rebound.

Conclusion

As Wall Street prepares for the unfolding of this earnings season, a collection of factors, including lowered expectations, potential rate cuts, and increased capital expenditures, will likely influence investor sentiment and guide decision-making. While some caution remains warranted, the innovative strides in capital investment amidst a backdrop of economic uncertainty could illuminate a pathway for future growth. For investors attuned to these dynamics, understanding these shifts is paramount in navigating what promises to be an eventful earnings landscape.

Do you have a news tip for our reporters? Please get in touch through our contact page.

Photo by

Photo by